EX-99.2

Published on May 29, 2018

TTM Technologies, Inc. Todd Schull, Chief Financial Officer May 22, 2018 Exhibit 99.2

Disclaimers Forward-Looking Statements This communication may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements related to the future business outlook, events, and expected performance of TTM Technologies, Inc. (“TTM”, “we” or the “Company”). The words “anticipate,” “believe,” “plan,” “forecast,” “foresee,” “estimate,” “project,” “expect,” “seek,” “target,” “intend,” “goal” and other similar expressions, among others, generally identify “forward-looking statements,” which speak only as of the date the statements were made and are not guarantees of performance. Actual results may differ materially from these forward-looking statements. Such statements relate to a variety of matters, including but not limited to the operations of TTM’s businesses. These statements reflect the current beliefs, expectations and assumptions of the management of TTM, and we believe such statements to have a reasonable basis. It is uncertain whether any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what impact they will have on the results of operations and financial condition of the Company. These forward-looking statements are based on assumptions that may not materialize, and involve certain risks and uncertainties, many of which are beyond our control, that could cause actual events or performance to differ materially from those indicated in such forward-looking statements. Factors, risks, trends, and uncertainties that could cause actual results to differ materially from those projected, anticipated, or implied in forward-looking statements include, but are not limited to, the ability to retain Anaren’s customers and employees, the ability to successfully integrate Anaren’s operations, product lines, technology and employees into TTM’s operations, and the ability to achieve the expected synergies as well as accretion in earnings, demand for our products, market pressures on prices of our products, warranty claims, changes in product mix, contemplated significant capital expenditures and related financing requirements, our dependence upon a small number of customers, and other factors set forth in the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q and in the Company’s other filings filed with the Securities and Exchange Commission (the “SEC”), including under the heading “Risk Factors”, and which are available at the SEC’s website at www.sec.gov. TTM does not undertake any obligation to update any of these statements to reflect any new information, subsequent events or circumstances, or otherwise, except as may be required by law, even if experience or future changes make it clear that any projected results expressed in this communication or future communications to stockholders, press releases or Company statements will not be realized. In addition, the inclusion of any statement in this communication does not constitute an admission by us that the events or circumstances described in such statement are material. None of Anaren, its affiliates or their respective representatives assume any responsibility for, or makes any representation or warranty, express or implied, (and they expressly disclaim any such representation or warranty and any liability related thereto) as to the accuracy, adequacy or completeness of the information contained in this communication or any other written or oral communication transmitted or made available to any person in connection with this communication. Use of Non-GAAP Financial Measures In addition to the financial statements presented in accordance with U.S. generally accepted accounting principles (“GAAP”), TTM uses certain non-GAAP financial measures, including EBITDA, Adjusted EBITDA, Non-GAAP Operating Income, Non-GAAP Net Income, Non-GAAP Operating Margin, Non-GAAP Gross Margin , Non-GAAP EPS and Adjusted Operating Cash Flow. We present non-GAAP financial information to enable investors to see TTM through the eyes of management and to provide better insight into our ongoing financial performance. A material limitation associated with the use of the above non-GAAP financial measures is that they have no standardized measurement prescribed by GAAP and may not be comparable to similar non-GAAP financial measures used by other companies. We compensate for these limitations by providing full disclosure of each non-GAAP financial measure and reconciliation to the most directly comparable GAAP financial measure. However, the non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. See Appendix for reconciliations of Adjusted EBITDA and Non-GAAP Operating Income to the most comparable GAAP metric. Data Used in This Presentation Due to rounding, numbers presented throughout this and other documents may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures. Third Party Information This presentation has been prepared by the Company and includes information from other sources believed by the Company to be reliable. No representation or warranty, express or implied, is made as to the fairness, accuracy or completeness of any of the opinions and conclusions set forth herein based on such information. This presentation may contain descriptions or summaries of certain documents and agreements, but such descriptions or summaries are qualified in their entirety by reference to the actual documents or agreements. Unless otherwise indicated, the information contained herein speaks only as of the date hereof and is subject to change, completion or amendment without notice.

Outline Who is TTM? Growth Drivers TTM Differentiation Recent Events TTM and Anaren Financial Highlights

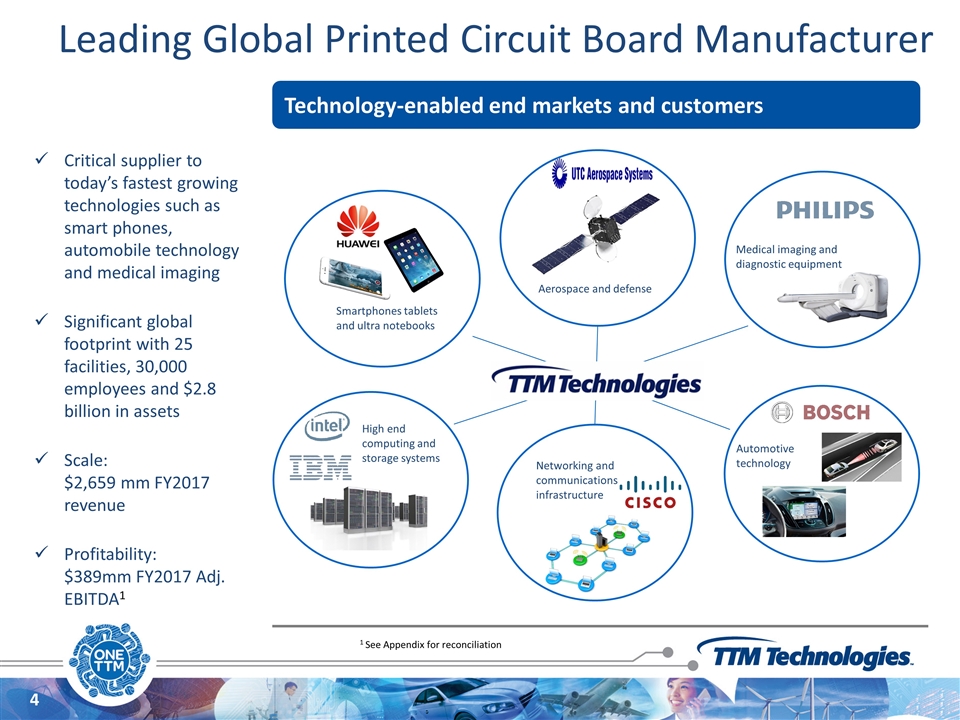

Critical supplier to today’s fastest growing technologies such as smart phones, automobile technology and medical imaging Significant global footprint with 25 facilities, 30,000 employees and $2.8 billion in assets Scale: $2,659 mm FY2017 revenue Profitability: $389mm FY2017 Adj. EBITDA1 Technology-enabled end markets and customers Leading Global Printed Circuit Board Manufacturer Smartphones tablets and ultra notebooks Aerospace and defense Automotive technology High end computing and storage systems Medical imaging and diagnostic equipment Networking and communications infrastructure 1 See Appendix for reconciliation

Why Invest in TTM? Solid end market growth with a focus on A&D and Auto Diverse end markets Differentiated through scale, scope and breadth Operating and financial leverage provides earnings power Strong free cash flow generation

End Market Growth Drivers and Outlook Source: TTM filings, Prismark Partners Feb 2017, BCA Research, Company estimates 1 Other mobile devices such as e-readers are included in the “Other” end market FY 2017 Net Sales 16% End Market Growth Drivers 2016 – 2021 CAGR (3rd party) Increased Commercial Air Traffic Increased Military Equipment Builds 2-4% Aerospace / Defense 2018 TTM View Above

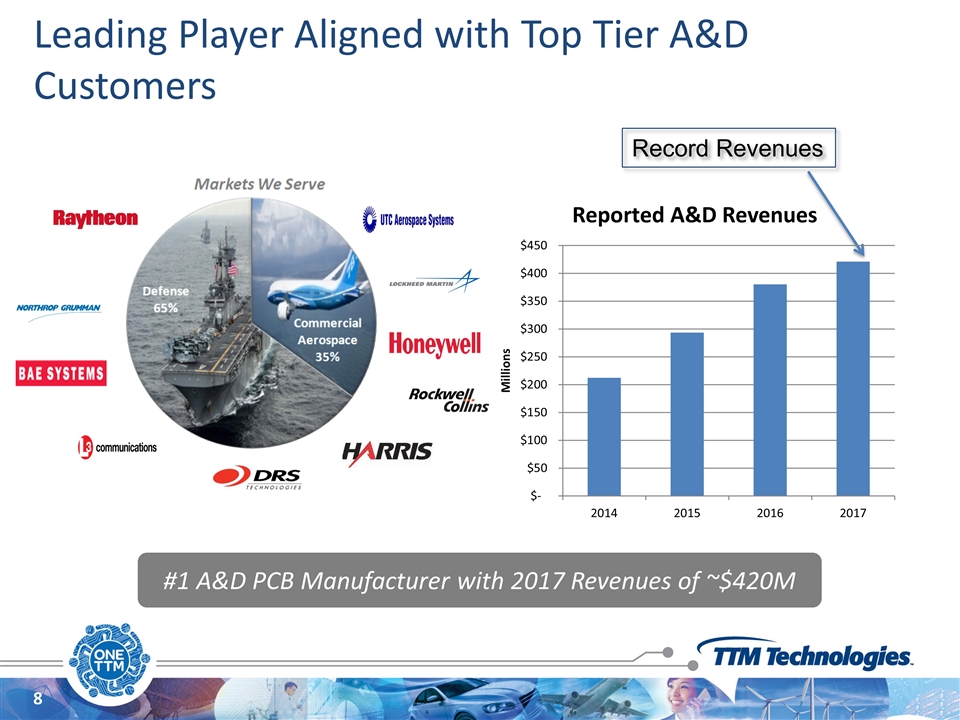

Aerospace and Defense Megatrends Commercial Fleet Upgrade Increasing Passenger Traffic Increasing Defense Budgets Key Program ramps Boeing record backlog 7.6% YoY 2017 Airline Traffic 20% Increase FY17-FY19 79 key DoD Program ramps

Leading Player Aligned with Top Tier A&D Customers Record Revenues #1 A&D PCB Manufacturer with 2017 Revenues of ~$420M

End Market Growth Drivers and Outlook Source: TTM filings, Prismark Partners Feb 2017, Company estimates 1 Other mobile devices such as e-readers are included in the “Other” end market FY 2017 Net Sales 16% End Market Growth Drivers 2016 – 2021 CAGR (3rd party) 5-8% Increased Commercial Air Traffic Increased Military Equipment Builds Automotive 19% Electric Vehicle Safety/ADAS/Infotainment 2-4% Aerospace / Defense 2018 TTM View Above In Line

Automotive Megatrends Vehicle Safety Advanced Driver Assistance Systems (radar, LiDar, cameras) CAGR 10% (Source: Markets and Markets) Automated Driving Sensors, Cameras, GPS, Radar, LiDar Artificial Intelligence CAGR 134% (Source: Business Insider, Lux Research) Connectivity/ Infotainment Wireless communication, High resolution/touch display, voice recognition CAGR 12% (Source: Research and Markets) EV/Hybrid Inverters/Converters Battery Management Charge Modules CAGR 23% (Source: Technavio, Bloomberg)

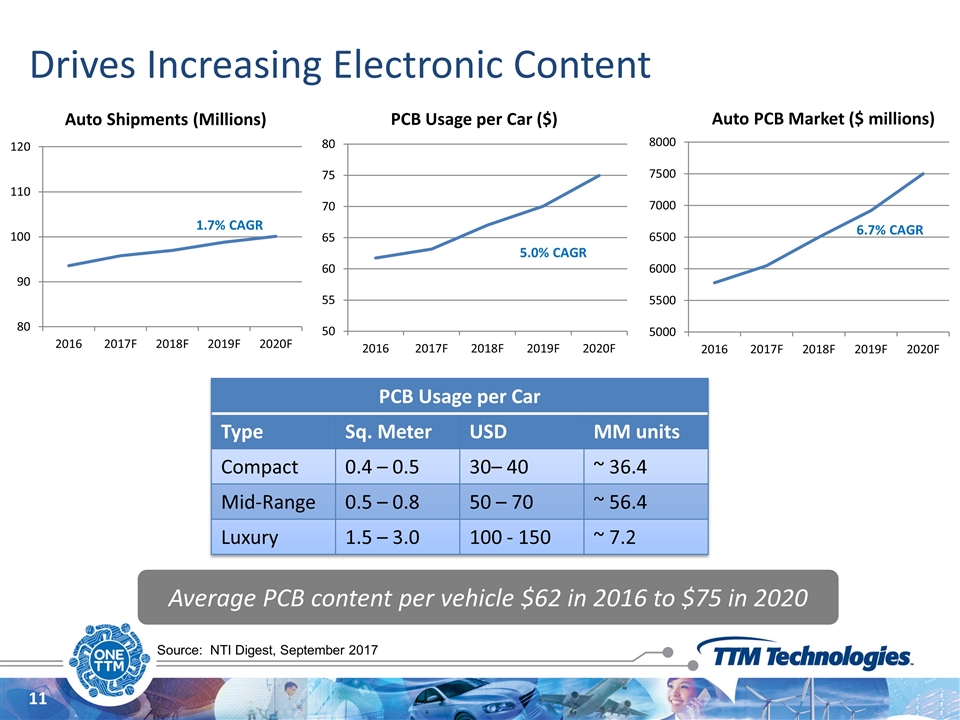

Drives Increasing Electronic Content PCB Usage per Car Type Sq. Meter USD MM units Compact 0.4 – 0.5 30– 40 ~ 36.4 Mid-Range 0.5 – 0.8 50 – 70 ~ 56.4 Luxury 1.5 – 3.0 100 - 150 ~ 7.2 Source: NTI Digest, September 2017 1.7% CAGR 5.0% CAGR 6.7% CAGR Average PCB content per vehicle $62 in 2016 to $75 in 2020

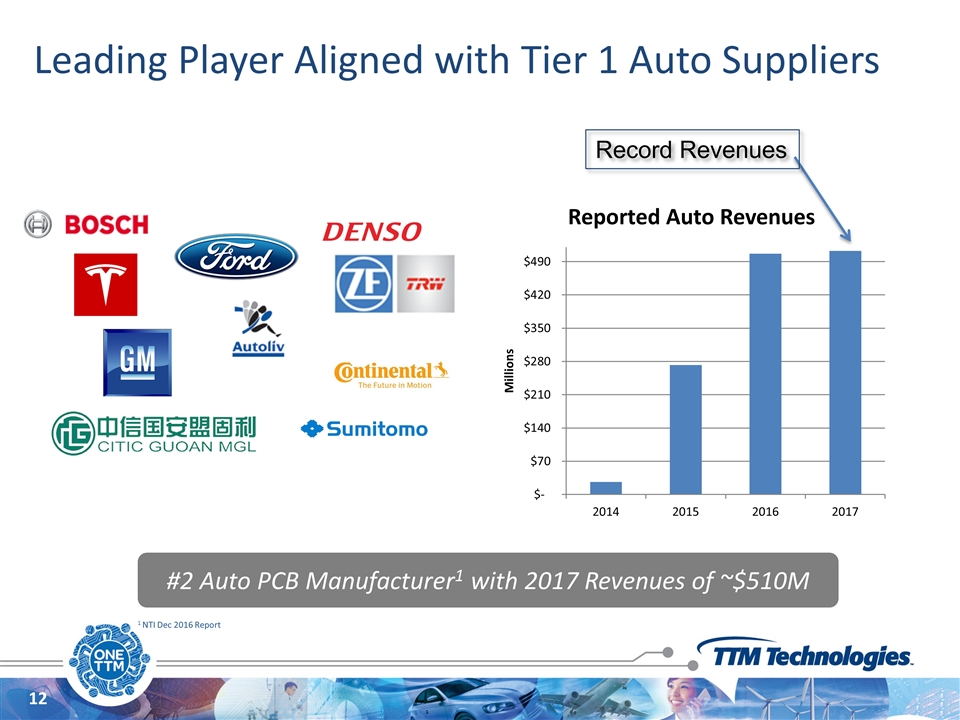

Leading Player Aligned with Tier 1 Auto Suppliers #2 Auto PCB Manufacturer1 with 2017 Revenues of ~$510M 1 NTI Dec 2016 Report Record Revenues

End Market Growth Drivers and Outlook Source: TTM filings, Prismark Partners Nov 2017, Company estimates 1 Other end market includes other consumer devices such as wearables, portable video devices and personal headphones Networking / Communications Medical / Industrial / Instrumentation 4G/5G Infrastructure Spend Data Center expansion 18% 14% 2% FY 2017 Net Sales 16% Cellular Phone 18% Computing / Storage / Peripherals 13% End Market Growth Drivers 2016 – 2021 CAGR (3rd Party) New Phone Functionality Emerging Markets 5-8% Increased Commercial Air Traffic Increased Military Equipment Builds High end PC’s Internet of Things Automotive 19% Electric Vehicle Safety/ADAS/Infotainment 5-8% Patient Monitoring Home Automation 1-3% 2-4% 0-2% 4-6% Aerospace / Defense Other1 2018 TTM View Above In Line In Line In Line In Line Below

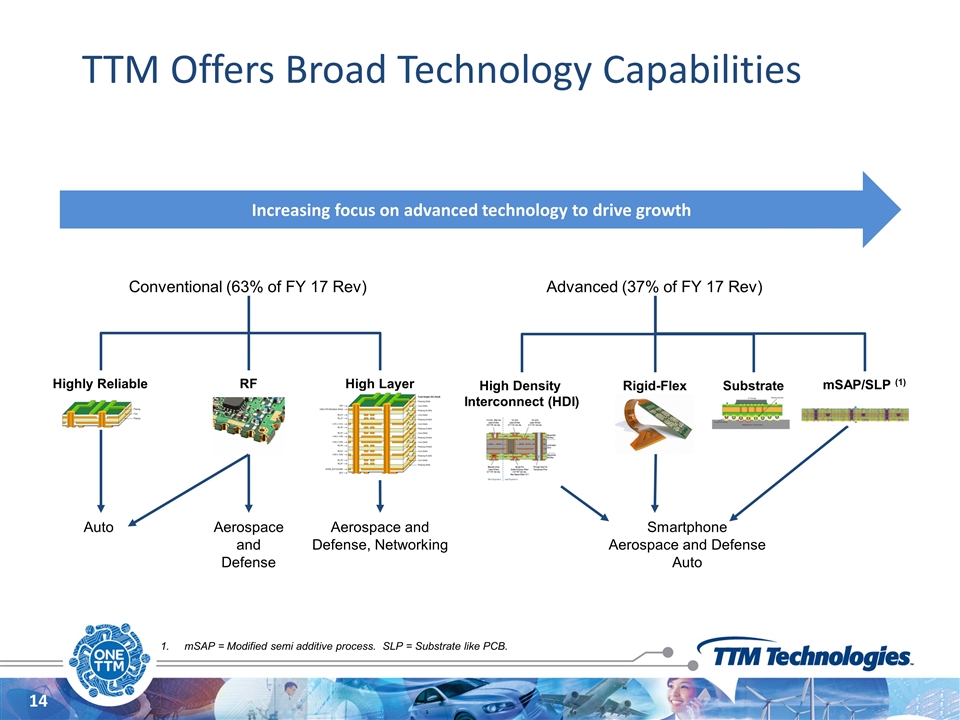

TTM Offers Broad Technology Capabilities Highly Reliable High Layer Conventional (63% of FY 17 Rev) High Density Interconnect (HDI) Advanced (37% of FY 17 Rev) RF Substrate Smartphone Aerospace and Defense Auto Aerospace and Defense, Networking Aerospace and Defense Auto Increasing focus on advanced technology to drive growth Rigid-Flex mSAP/SLP (1) mSAP = Modified semi additive process. SLP = Substrate like PCB.

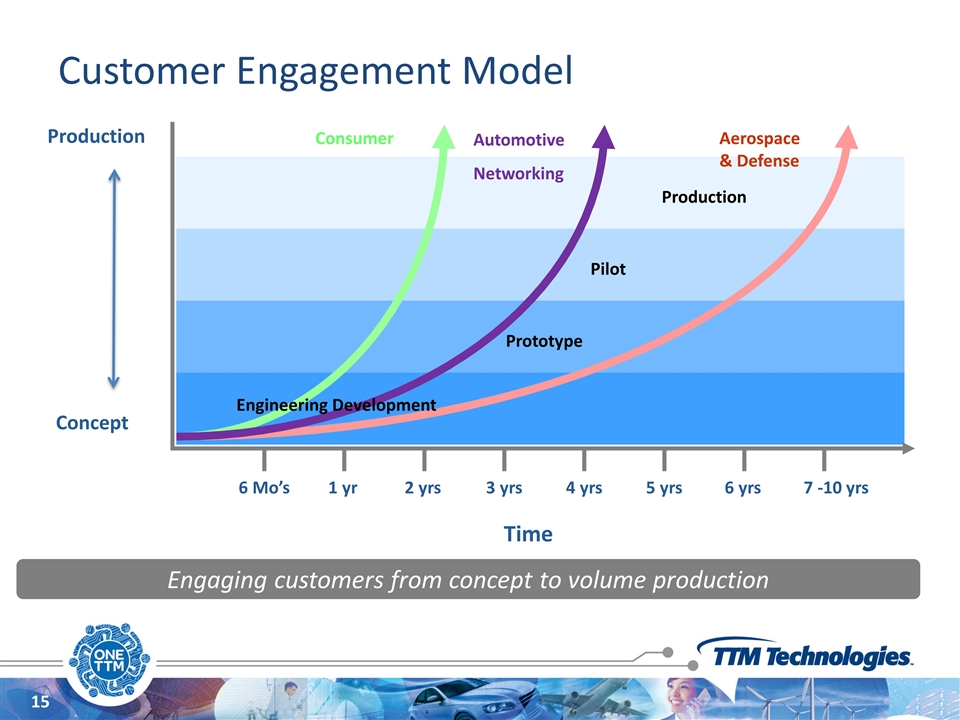

Customer Engagement Model Time Concept Production Pilot Production Consumer Aerospace & Defense Automotive Networking Engineering Development Prototype 6 Mo’s 1 yr 2 yrs 3 yrs 4 yrs 5 yrs 6 yrs 7 -10 yrs Engaging customers from concept to volume production

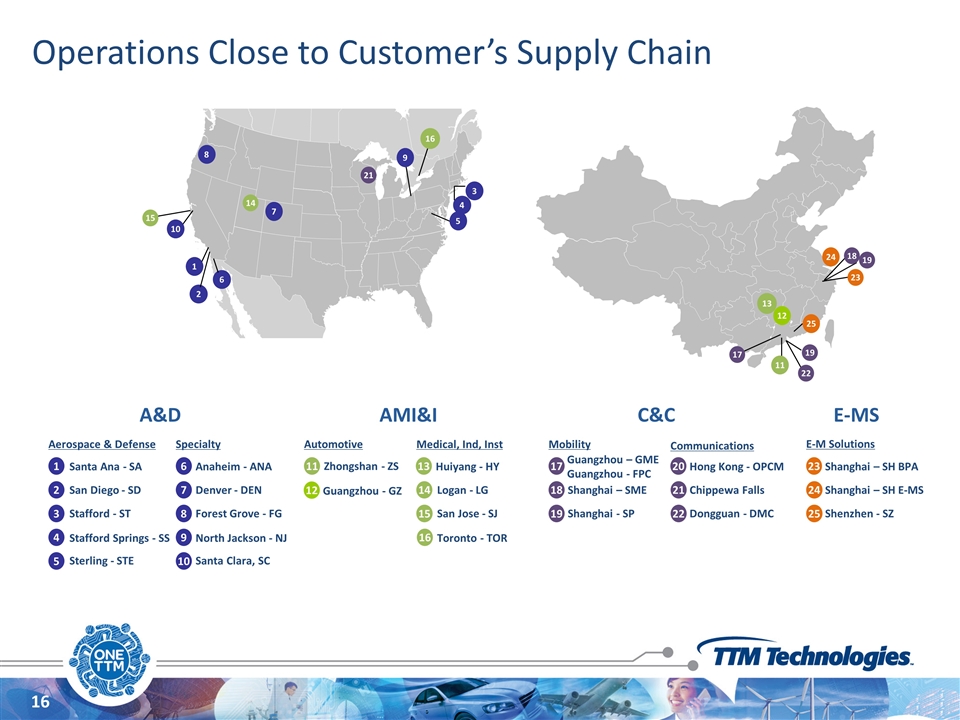

12 Operations Close to Customer’s Supply Chain 12 13 18 19 23 24 7 9 1 10 8 5 16 3 4 21 14 6 15 11 19 17 22 2 25 Zhongshan - ZS 21 Chippewa Falls 22 Dongguan - DMC Hong Kong - OPCM 20 Communications Medical, Ind, Inst 16 Toronto - TOR 14 Logan - LG 15 San Jose - SJ Mobility 19 Shanghai - SP 17 Guangzhou – GME Guangzhou - FPC 18 Shanghai – SME Aerospace & Defense 5 Sterling - STE Stafford Springs - SS 4 1 Santa Ana - SA 3 Stafford - ST 2 San Diego - SD Specialty 6 Anaheim - ANA 7 Denver - DEN 8 Forest Grove - FG 9 North Jackson - NJ Santa Clara, SC 10 Automotive 13 Huiyang - HY 11 24 Shanghai – SH E-MS 25 Shenzhen - SZ Shanghai – SH BPA 23 E-M Solutions A&D AMI&I C&C E-MS Guangzhou - GZ

Recent Events TTM Technologies, Inc. Acquisition of Anaren, Inc.

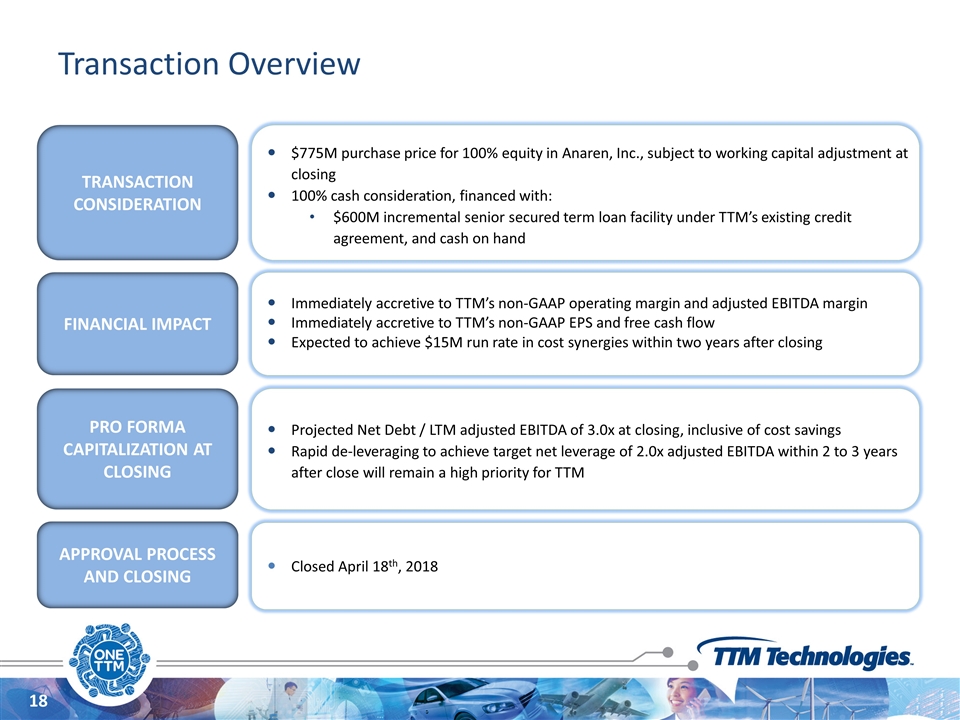

Transaction Overview $775M purchase price for 100% equity in Anaren, Inc., subject to working capital adjustment at closing 100% cash consideration, financed with: $600M incremental senior secured term loan facility under TTM’s existing credit agreement, and cash on hand TRANSACTION CONSIDERATION Closed April 18th, 2018 APPROVAL PROCESS AND CLOSING Immediately accretive to TTM’s non-GAAP operating margin and adjusted EBITDA margin Immediately accretive to TTM’s non-GAAP EPS and free cash flow Expected to achieve $15M run rate in cost synergies within two years after closing FINANCIAL IMPACT Projected Net Debt / LTM adjusted EBITDA of 3.0x at closing, inclusive of cost savings Rapid de-leveraging to achieve target net leverage of 2.0x adjusted EBITDA within 2 to 3 years after close will remain a high priority for TTM PRO FORMA CAPITALIZATION AT CLOSING

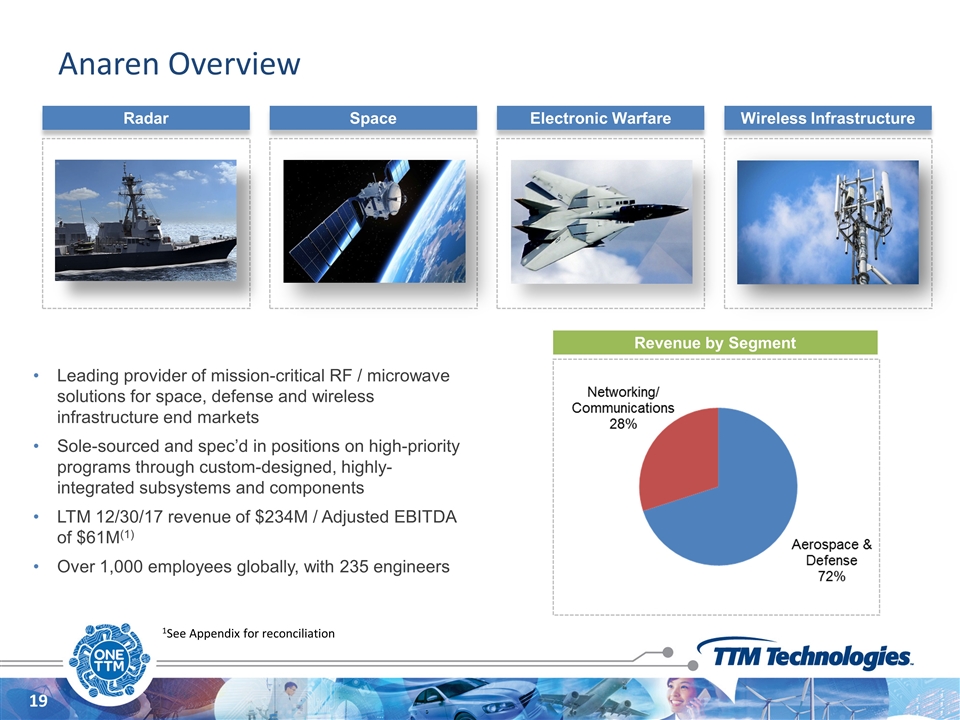

Anaren Overview Leading provider of mission-critical RF / microwave solutions for space, defense and wireless infrastructure end markets Sole-sourced and spec’d in positions on high-priority programs through custom-designed, highly- integrated subsystems and components LTM 12/30/17 revenue of $234M / Adjusted EBITDA of $61M(1) Over 1,000 employees globally, with 235 engineers Revenue by Segment Radar Space Electronic Warfare Wireless Infrastructure 1See Appendix for reconciliation

Strategic Rationale Provides differentiated RF expertise in space & defense and embedded technology critical to wireless infrastructure Enhances TTM’s strong A&D position and provides new market growth opportunity for the industrial, medical and automotive markets Significantly enhances TTM’s A&D business from “Build to Print” to “Build to Spec” Combined customer base includes industry leaders in aerospace & defense and wireless communication infrastructure markets Strong management and engineering talent with extensive experience in the RF design Compelling value creation with Anaren projected to be accretive to TTM’s non-GAAP operating margin, adjusted EBITDA margin, non-GAAP EPS and free cash flow

Financial Overview

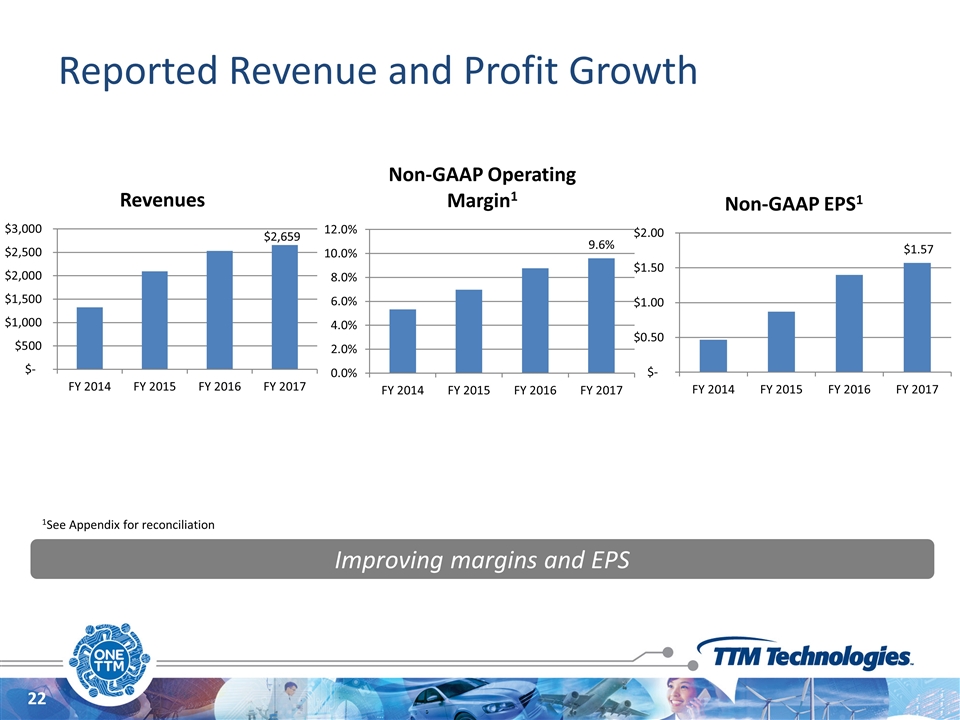

Reported Revenue and Profit Growth Improving margins and EPS 1See Appendix for reconciliation

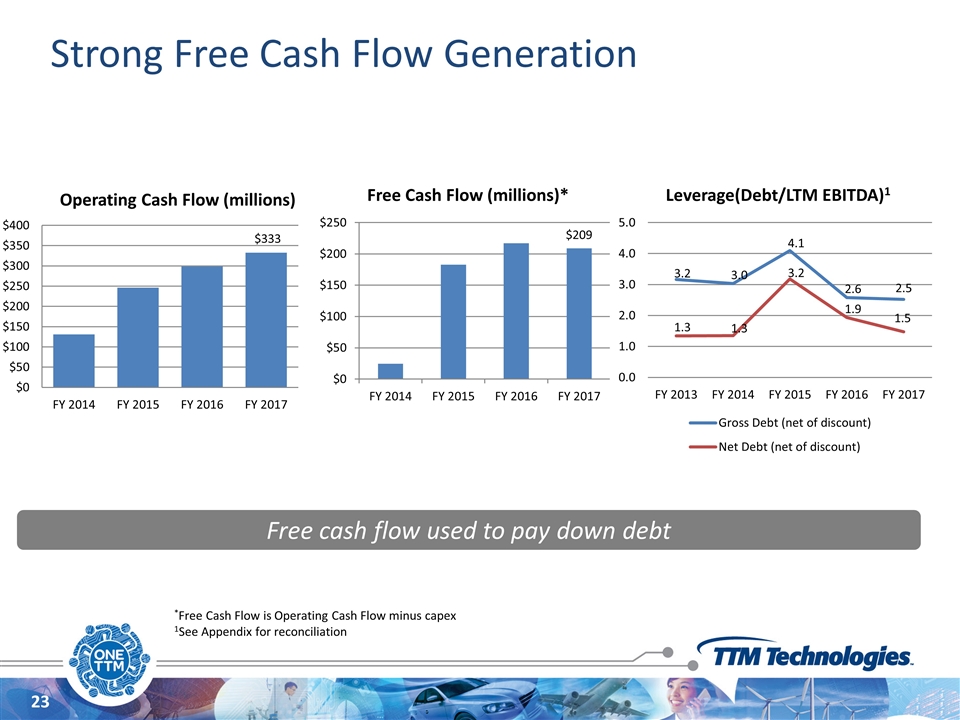

Strong Free Cash Flow Generation *Free Cash Flow is Operating Cash Flow minus capex 1See Appendix for reconciliation Free cash flow used to pay down debt

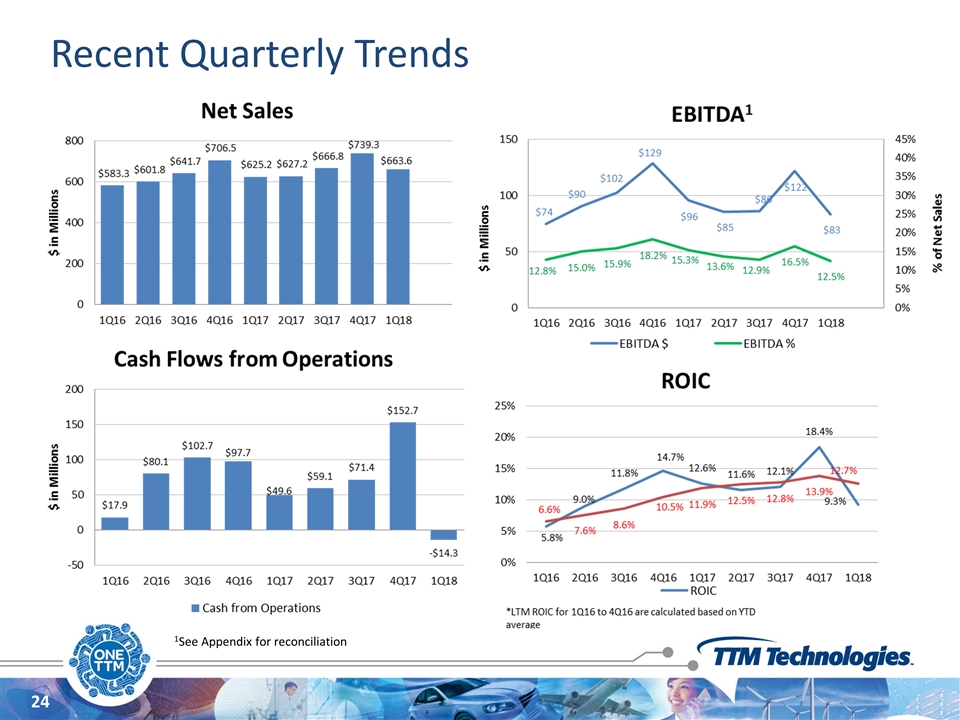

Recent Quarterly Trends 1See Appendix for reconciliation

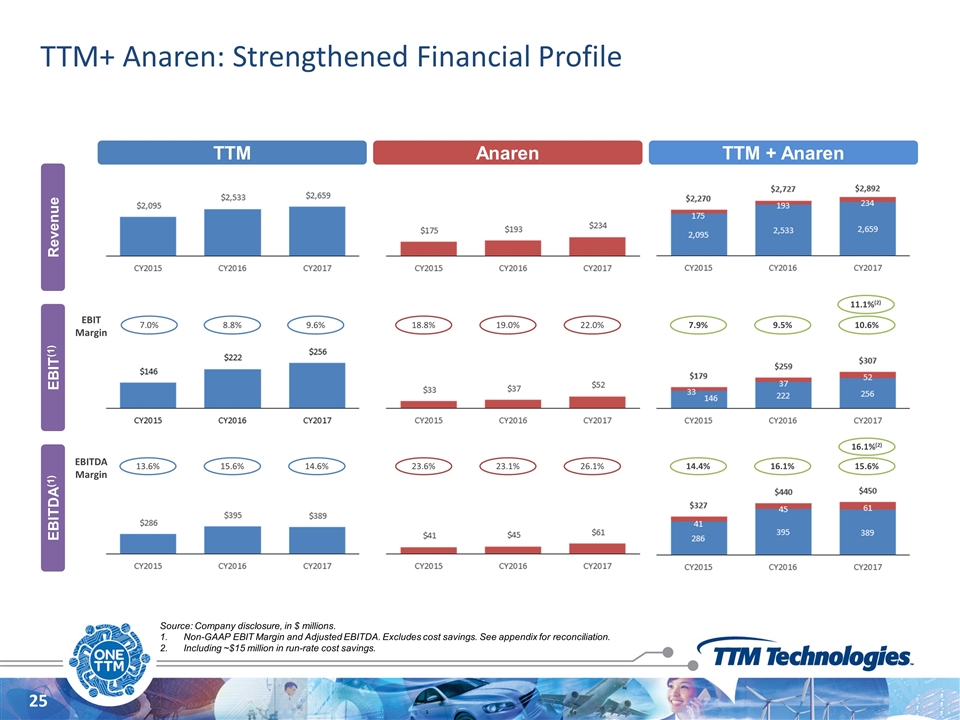

TTM+ Anaren: Strengthened Financial Profile 25 Revenue EBITDA(1) Source: Company disclosure, in $ millions. Non-GAAP EBIT Margin and Adjusted EBITDA. Excludes cost savings. See appendix for reconciliation. Including ~$15 million in run-rate cost savings. EBIT(1) TTM Anaren TTM + Anaren 14.4% 16.1% 15.6% EBITDA Margin 16.1%(2) 13.6% 15.6% 14.6% 7.0% 8.8% 9.6% 23.6% 23.1% 26.1% 18.8% 19.0% 22.0% 7.9% 9.5% 10.6% EBIT Margin 11.1%(2)

Investment Highlights Global leader in the PCB manufacturing market with emphasis on advanced technology Diverse end markets with growth opportunities in automotive and aerospace and defense One stop shop offering a breadth of products and services ranging from concept to volume production globally Improving margins and strong free cash flow generation Anaren acquisition adds significant “build to spec” capability to TTM portfolio and the opportunity to improve financial profile

Appendix

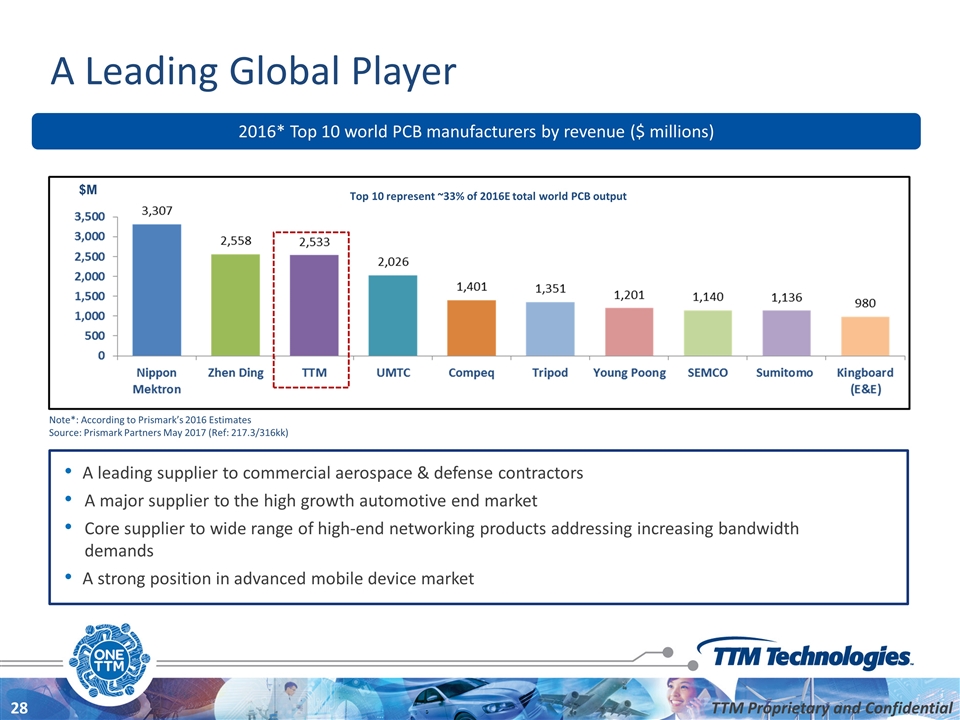

A Leading Global Player 2016* Top 10 world PCB manufacturers by revenue ($ millions) Note*: According to Prismark’s 2016 Estimates Source: Prismark Partners May 2017 (Ref: 217.3/316kk) Top 10 represent ~33% of 2016E total world PCB output $M A leading supplier to commercial aerospace & defense contractors A major supplier to the high growth automotive end market Core supplier to wide range of high-end networking products addressing increasing bandwidth demands A strong position in advanced mobile device market TTM Proprietary and Confidential

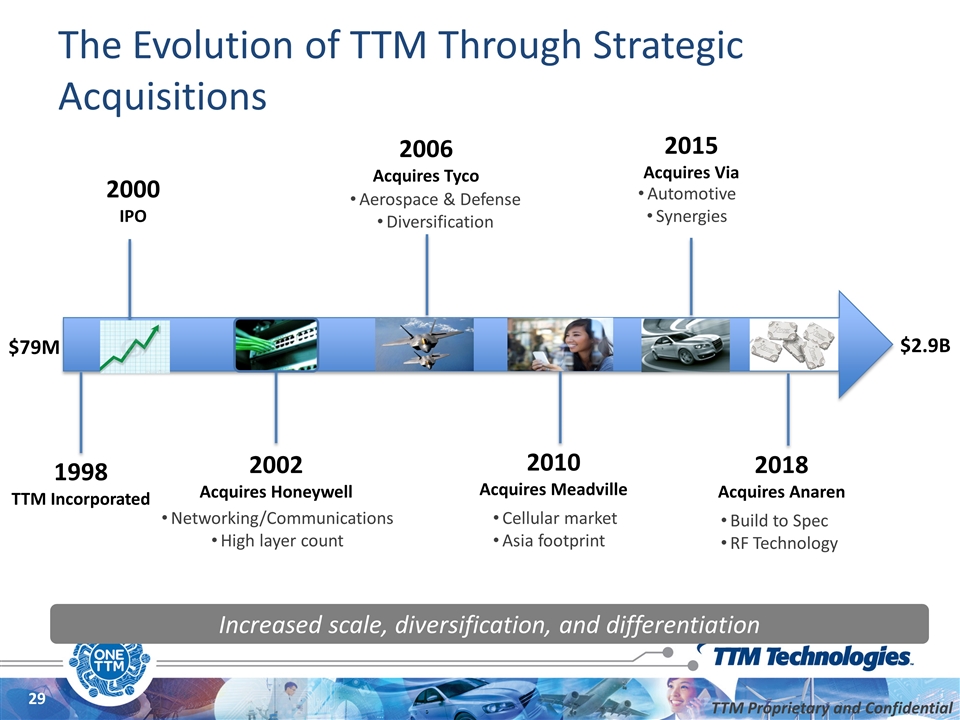

The Evolution of TTM Through Strategic Acquisitions 1998 TTM Incorporated 2000 IPO 2002 Acquires Honeywell 2006 Acquires Tyco 2010 Acquires Meadville 2015 Acquires Via Networking/Communications High layer count Cellular market Asia footprint Automotive Synergies Aerospace & Defense Diversification $2.9B $79M TTM Proprietary and Confidential 2018 Acquires Anaren Build to Spec RF Technology Increased scale, diversification, and differentiation

Focused Defense Product Area’s Microwave Systems F-35 (JSF) AMDR Q-53 F-16 (SABR) JSTARS SEWIP Missile Systems AMRAAM Standard Missile JAGM JDAM Hellfire Paveway Communication Systems JTRS Soldier Radio Rifleman MANPACK Space Systems Orion GOES GPS III SBIRS XM4

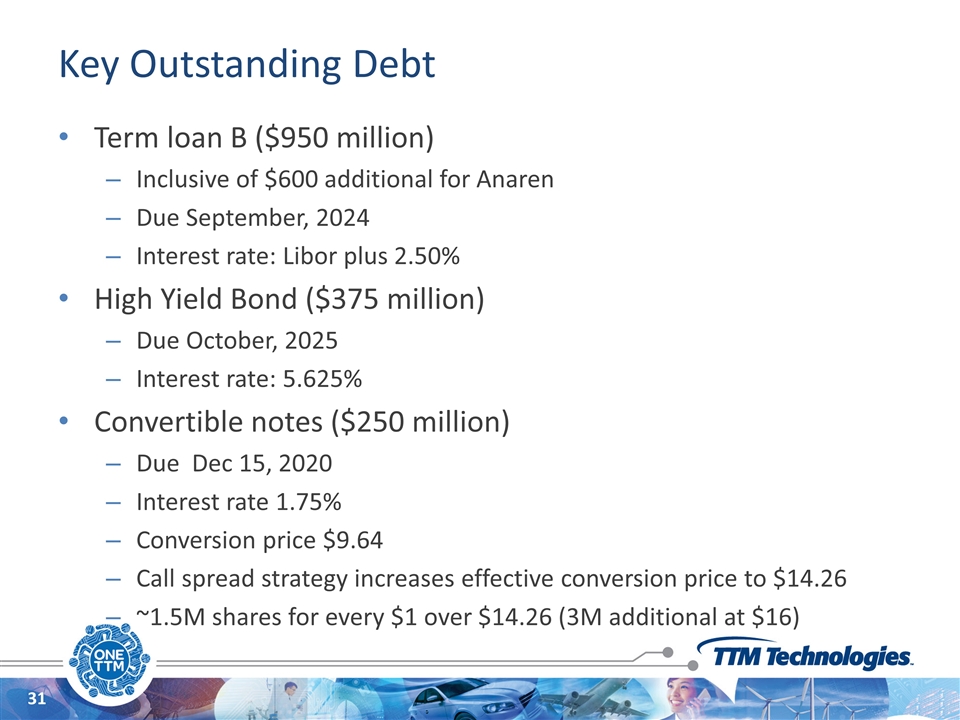

Key Outstanding Debt Term loan B ($950 million) Inclusive of $600 additional for Anaren Due September, 2024 Interest rate: Libor plus 2.50% High Yield Bond ($375 million) Due October, 2025 Interest rate: 5.625% Convertible notes ($250 million) Due Dec 15, 2020 Interest rate 1.75% Conversion price $9.64 Call spread strategy increases effective conversion price to $14.26 ~1.5M shares for every $1 over $14.26 (3M additional at $16)

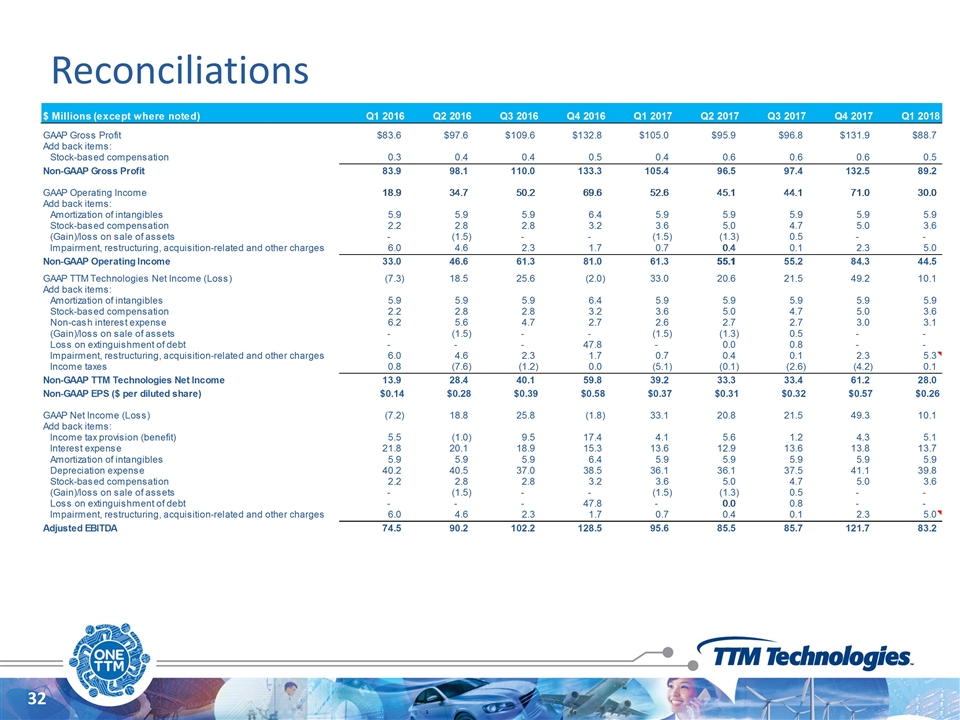

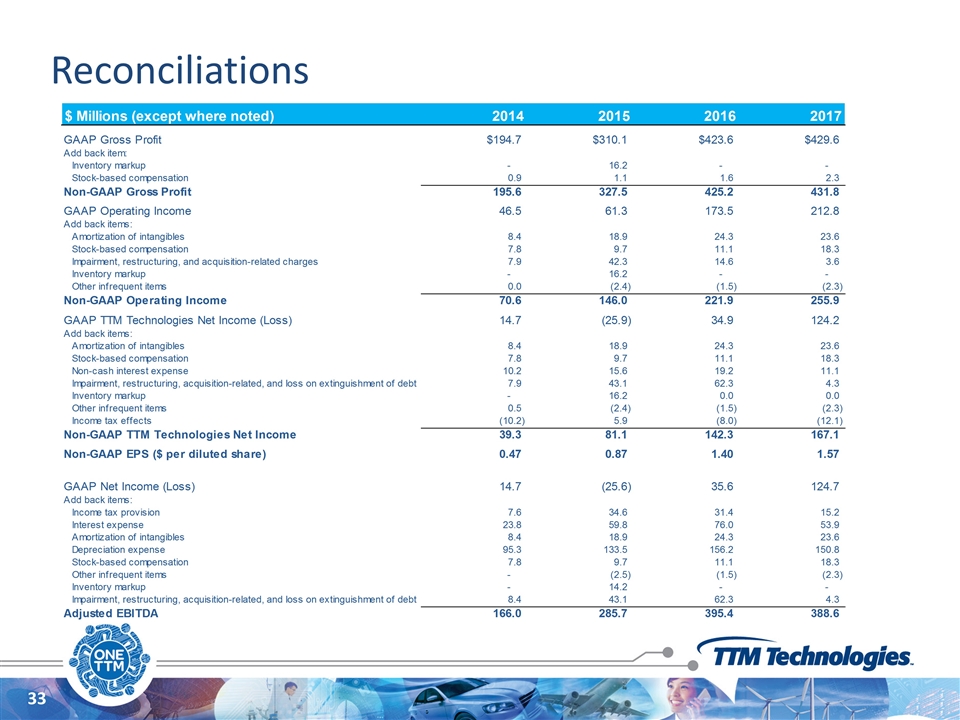

Reconciliations

Reconciliations

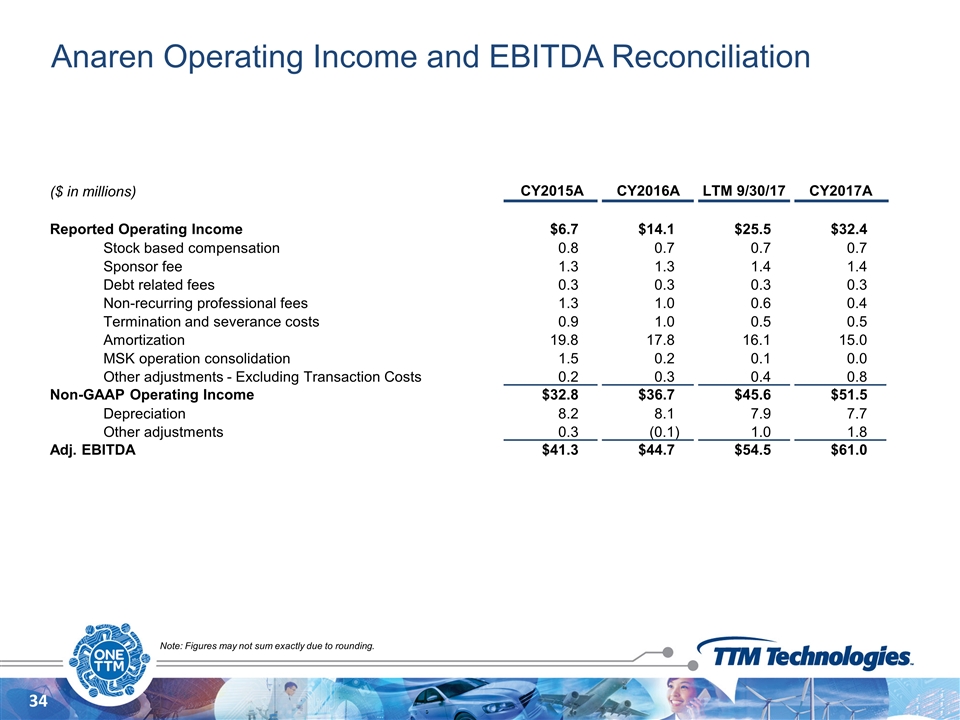

Anaren Operating Income and EBITDA Reconciliation Note: Figures may not sum exactly due to rounding. ($ in millions) CY2015A CY2016A LTM 9/30/17 CY2017A Reported Operating Income $6.7 $14.1 $25.5 $32.4 Stock based compensation 0.8 0.7 0.7 0.7 Sponsor fee 1.3 1.3 1.4 1.4 Debt related fees 0.3 0.3 0.3 0.3 Non-recurring professional fees 1.3 1.0 0.6 0.4 Termination and severance costs 0.9 1.0 0.5 0.5 Amortization 19.8 17.8 16.1 15.0 MSK operation consolidation 1.5 0.2 0.1 0.0 Other adjustments - Excluding Transaction Costs 0.2 0.3 0.4 0.8 Non-GAAP Operating Income $32.8 $36.7 $45.6 $51.5 Depreciation 8.2 8.1 7.9 7.7 Other adjustments 0.3 (0.1) 1.0 1.8 Adj. EBITDA $41.3 $44.7 $54.5 $61.0