EX-99.2

Published on April 18, 2022

TTM Technologies, Inc. Announces Acquisition of Telephonics Corporation Investor Presentation 4/18/2022 Exhibit 99.2

Disclaimers Forward-Looking Statements This communication may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements related to the future business outlook, events, and expected performance of TTM Technologies, Inc. (“TTM”, “we” or the “Company”). The words “anticipate,” “believe,” “plan,” “forecast,” “foresee,” “estimate,” “project,” “expect,” “seek,” “target,” “intend,” “goal” and other similar expressions, among others, generally identify “forward-looking statements,” which speak only as of the date the statements were made and are not guarantees of performance. Actual results may differ materially from these forward-looking statements. Such statements relate to a variety of matters, including but not limited to the operations of TTM’s businesses. These statements reflect the current beliefs, expectations and assumptions of the management of TTM, and we believe such statements to have a reasonable basis. It is uncertain whether any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what impact they will have on the results of operations and financial condition of the Company. These forward-looking statements are based on assumptions that may not materialize, and involve certain risks and uncertainties, many of which are beyond our control, that could cause actual events or performance to differ materially from those indicated in such forward-looking statements. Factors, risks, trends, and uncertainties that could cause actual results to differ materially from those projected, anticipated, or implied in forward-looking statements include, but are not limited to, TTM’s ability to successfully complete the transaction on a timely basis, including receipt of required regulatory approvals and satisfaction of other conditions; if the transaction is completed, the ability to retain Telephonics’ customers and employees, the ability to successfully integrate Telephonics’ operations, product lines, technology and employees into TTM’s operations, and the ability to achieve the expected synergies as well as accretion in earnings, demand for our products, market pressures on prices of our products, warranty claims, changes in product mix, contemplated significant capital expenditures and related financing requirements, our dependence upon a small number of customers, and other factors set forth in the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q and in the Company’s other filings filed with the Securities and Exchange Commission (the “SEC”), including under the heading “Risk Factors”, and which are available at the SEC’s website at www.sec.gov. TTM does not undertake any obligation to update any of these statements to reflect any new information, subsequent events or circumstances, or otherwise, except as may be required by law, even if experience or future changes make it clear that any projected results expressed in this communication or future communications to stockholders, press releases or Company statements will not be realized. In addition, the inclusion of any statement in this communication does not constitute an admission by us that the events or circumstances described in such statement are material. None of Telephonics, its affiliates or their respective representatives assume any responsibility for, or makes any representation or warranty, express or implied, (and they expressly disclaim any such representation or warranty and any liability related thereto) as to the accuracy, adequacy or completeness of the information contained in this communication or any other written or oral communication transmitted or made available to any person in connection with this communication. Use of Non-GAAP Financial Measures In addition to the financial statements presented in accordance with U.S. generally accepted accounting principles (“GAAP”), TTM uses certain non-GAAP financial measures, including EBITDA, Adjusted EBITDA, Non-GAAP Operating Income, Non-GAAP Net Income, Non-GAAP Operating Margin, Non-GAAP Gross Margin , Non-GAAP EPS and Adjusted Operating Cash Flow. We present non-GAAP financial information to enable investors to see TTM through the eyes of management and to provide better insight into our ongoing financial performance. A material limitation associated with the use of the above non-GAAP financial measures is that they have no standardized measurement prescribed by GAAP and may not be comparable to similar non-GAAP financial measures used by other companies. We compensate for these limitations by providing full disclosure of each non-GAAP financial measure and reconciliation to the most directly comparable GAAP financial measure. However, the non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Data Used in This Presentation Due to rounding, numbers presented throughout this and other documents may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures. Third Party Information This presentation has been prepared by the Company and includes information from other sources believed by the Company to be reliable. No representation or warranty, express or implied, is made as to the fairness, accuracy or completeness of any of the opinions and conclusions set forth herein based on such information. This presentation may contain descriptions or summaries of certain documents and agreements, but such descriptions or summaries are qualified in their entirety by reference to the actual documents or agreements. Unless otherwise indicated, the information contained herein speaks only as of the date hereof and is subject to change, completion or amendment without notice.

Complementary portfolio and skills expected to enhance TTM’s strategic capabilities and growth opportunities in Aerospace & Defense Anticipate significant benefits to our customers driven by accelerated innovation, new capabilities, and enhanced manufacturing discipline Expands RF/Microwave product strategy and builds upon prior acquisition of Anaren Significant value creation potential from revenue and cost synergies Strong revenue synergies projected from new business opportunities, particularly in communications, surveillance, radar, and electronic warfare Meaningful cost synergies expected from organizational alignment, corporate and back office integration, manufacturing and supply chain, product and technology alignment Compelling financial benefits Immediately accretive to non-GAAP EPS $12M of estimated annual run-rate cost synergies by the end of 2024 TTM to Acquire Telephonics Overview

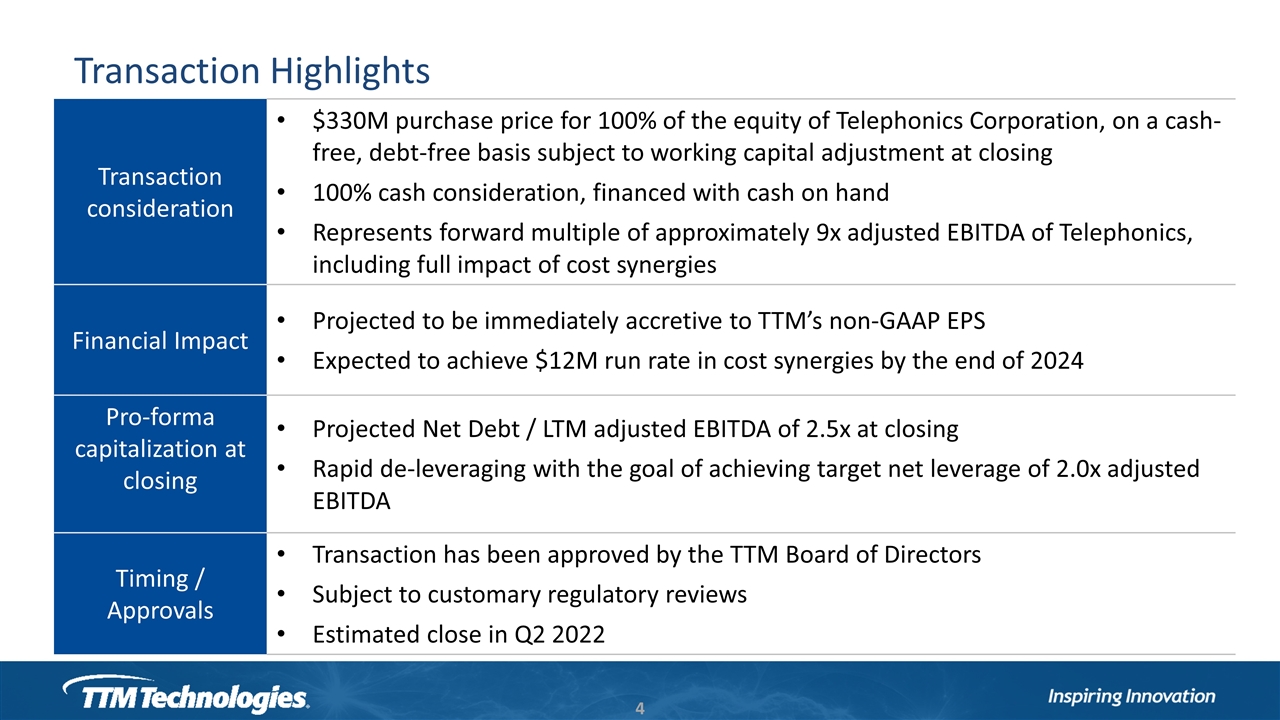

Transaction consideration $330M purchase price for 100% of the equity of Telephonics Corporation, on a cash-free, debt-free basis subject to working capital adjustment at closing 100% cash consideration, financed with cash on hand Represents forward multiple of approximately 9x adjusted EBITDA of Telephonics, including full impact of cost synergies Financial Impact Projected to be immediately accretive to TTM’s non-GAAP EPS Expected to achieve $12M run rate in cost synergies by the end of 2024 Pro-forma capitalization at closing Projected Net Debt / LTM adjusted EBITDA of 2.5x at closing Rapid de-leveraging with the goal of achieving target net leverage of 2.0x adjusted EBITDA Timing / Approvals Transaction has been approved by the TTM Board of Directors Subject to customary regulatory reviews Estimated close in Q2 2022 Transaction Highlights

Complementary capabilities build upon previous acquisition of Anaren with addition of RF-based integrated systems for key defense mission areas Continues TTM’s journey to become a larger provider of custom designed solutions and highly-engineered products Projected to increase TTM’s A&D end-market exposure to approximately 40% of TTM’s revenues, or approximately $1 billion Expands TTM’s defense customer base through international opportunities and establishes TTM as a Tier 1 supplier to DoD Strong engineering talent with extensive experience in critical specialties Meaningful value creation opportunity with significant expected cost and revenue synergies Expected to be immediately accretive to TTM’s non-GAAP EPS Strategic Rationale

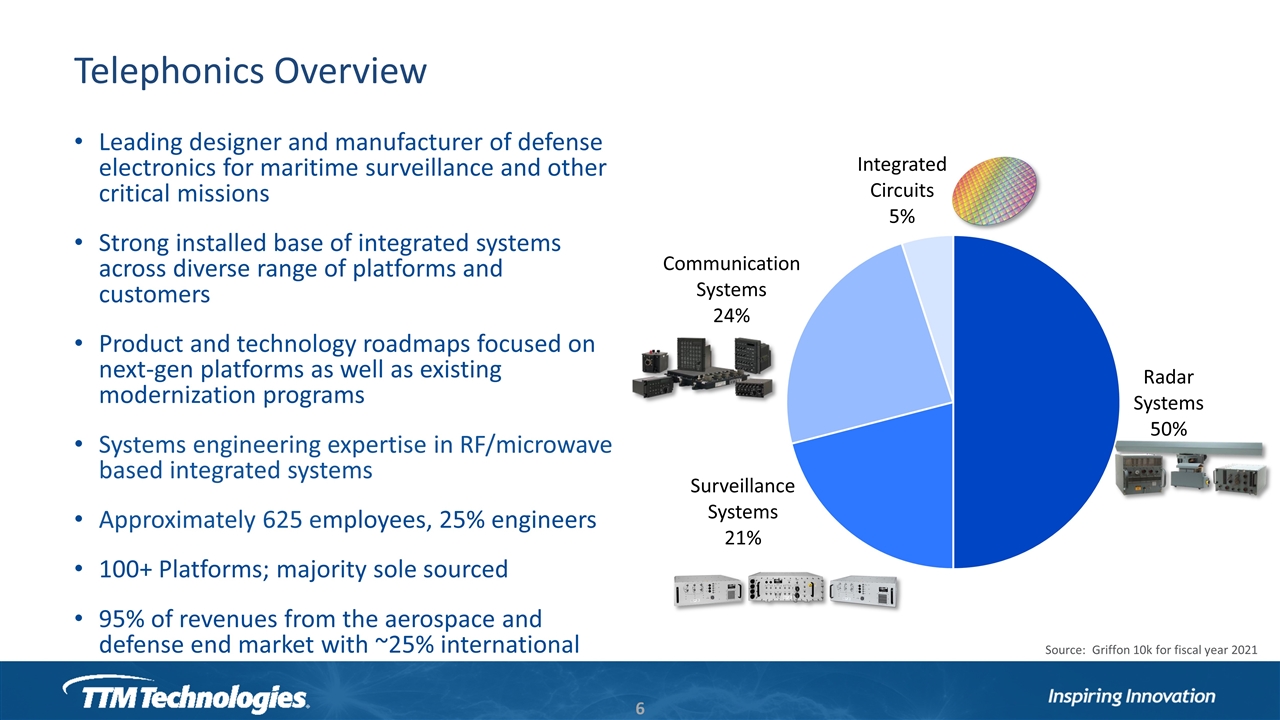

Telephonics Overview Leading designer and manufacturer of defense electronics for maritime surveillance and other critical missions Strong installed base of integrated systems across diverse range of platforms and customers Product and technology roadmaps focused on next-gen platforms as well as existing modernization programs Systems engineering expertise in RF/microwave based integrated systems Approximately 625 employees, 25% engineers 100+ Platforms; majority sole sourced 95% of revenues from the aerospace and defense end market with ~25% international

Complementary Programs and Customers Key TTM Defense Programs F-35 JSF Key Telephonics Defense Programs UH-60 Blackhawk MH-60 Romeo P-8 LTAMDS AN/SPY-6 Key TTM Defense Customers Key Telephonics Defense Customers

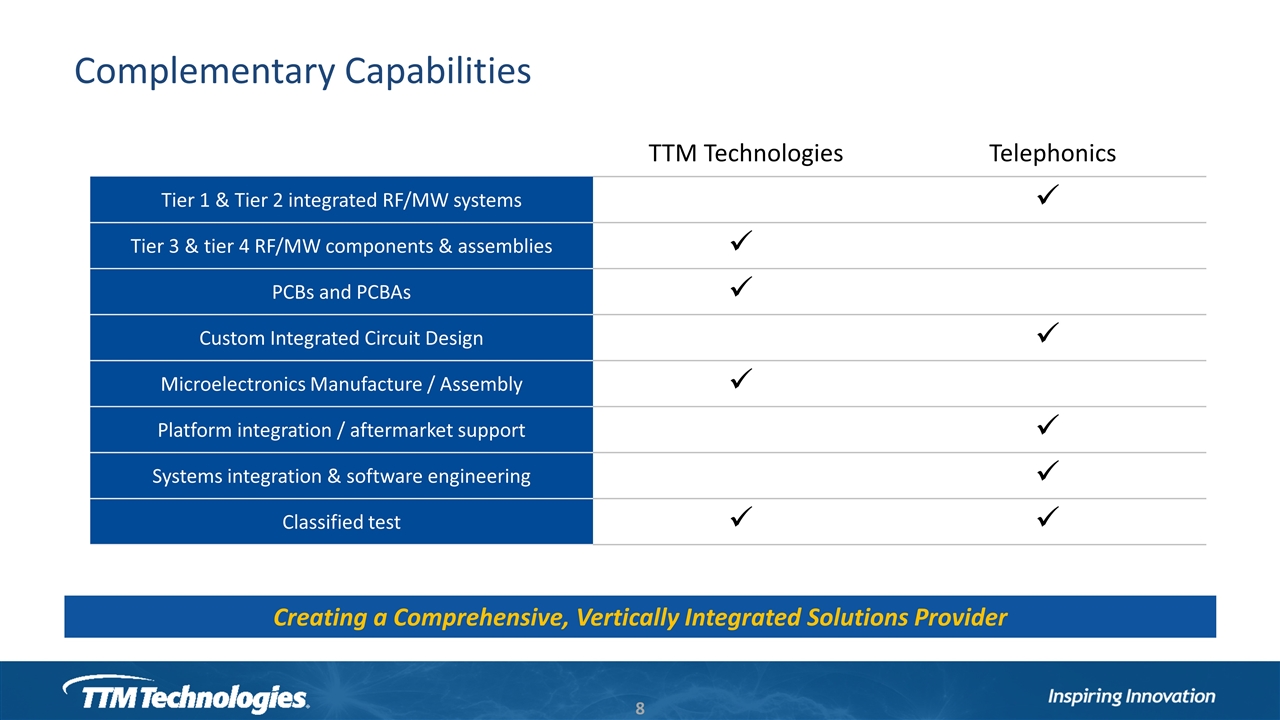

Complementary Capabilities TTM Technologies Telephonics Tier 1 & Tier 2 integrated RF/MW systems Tier 3 & tier 4 RF/MW components & assemblies PCBs and PCBAs Custom Integrated Circuit Design Microelectronics Manufacture / Assembly Platform integration / aftermarket support Systems integration & software engineering Classified test Creating a Comprehensive, Vertically Integrated Solutions Provider

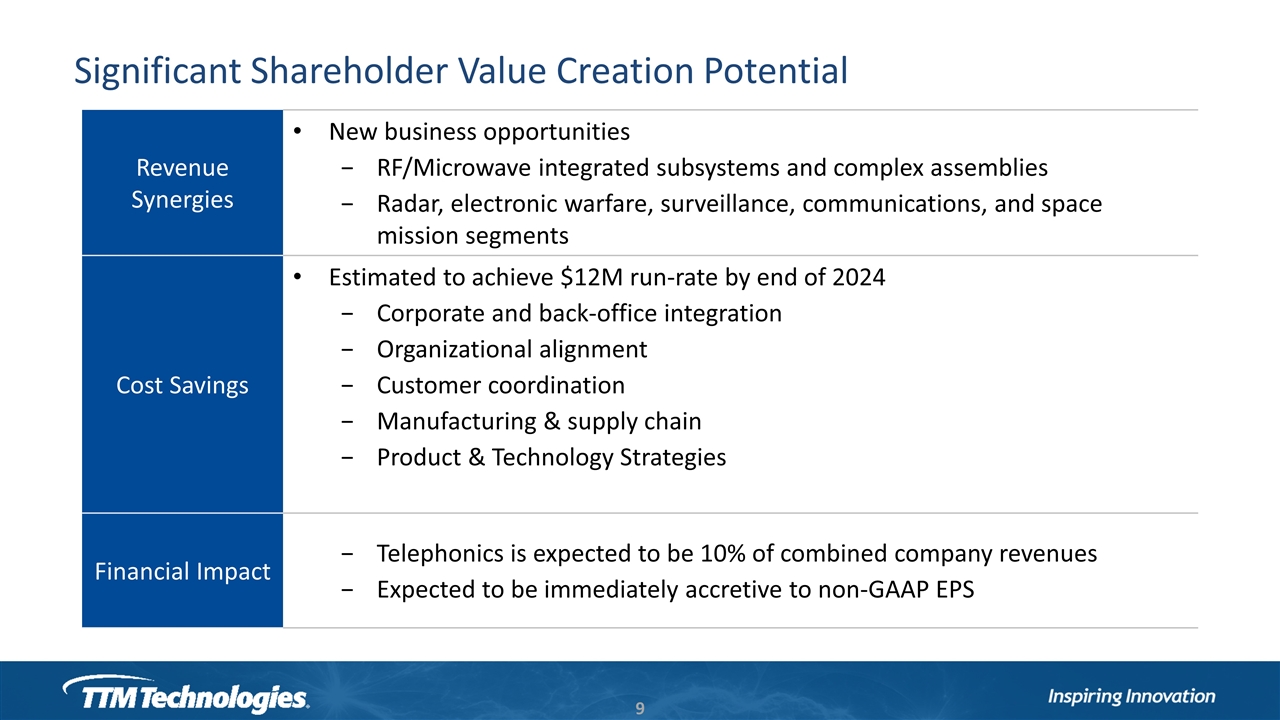

Significant Shareholder Value Creation Potential Revenue Synergies New business opportunities RF/Microwave integrated subsystems and complex assemblies Radar, electronic warfare, surveillance, communications, and space mission segments Cost Savings Estimated to achieve $12M run-rate by end of 2024 Corporate and back-office integration Organizational alignment Customer coordination Manufacturing & supply chain Product & Technology Strategies Financial Impact Telephonics is expected to be 10% of combined company revenues Expected to be immediately accretive to non-GAAP EPS

Strengthens TTM’s differentiated position in attractive A&D market Complements existing RF and microwave business and enhances TTM’s A&D overall product offering through integrated system solutions Meaningful value creation opportunity driven by strategic fit and synergies Transaction expected to be immediately accretive to non-GAAP EPS Key Takeaways

End