EX-99.1

Published on May 17, 2005

Searchable text section of graphics shown above

Safe Harbor Provision

[LOGO]

During the course of this presentation, we will make projections or other forward-looking statements regarding future events or the future financial performance of the Company. We wish to caution you that such statements reflect only our current expectations, and that actual events or results may differ materially.

We refer you to the risk factors and cautionary language contained in the documents that the Company files from time to time with the Securities and Exchange Commission, specifically the Companys most recent S-3 Registration Statement and Form 10-K. Such documents contain and identify important factors that could cause the actual results to differ materially from those contained in our projections or forward-looking statements. We undertake no obligation to update such projections or such forward-looking statements in the future.

2

Company Overview

TTM is a leading provider of time-critical and technologically complex printed circuit boards to the worlds leading electronic equipment designers and manufacturers

[GRAPHIC]

Pure Play printed circuit board (PCB) manufacturer

Focused on time (24 hrs to 10 days) & technology service segments

Three integrated, mission-focused production facilities:

Santa Ana, CA

Redmond, WA

Chippewa Falls, WI

$58.9 million in 1Q 2005 sales

1,736 employees

4

Investment Highlights

Focused Strategy & Leading Market Position

Leader in most attractive PCB segments time & technology

Mission-focused facilities speed, flexibility and technology

Demonstrated Execution Excellence

Strong relationships with leading OEM and EMS customers

Proven ability to integrate acquisitions

Cross-selling efforts leading to success

Industry Leading Financial Performance

Profitable business model across cycle

Strong balance sheet

Market Leadership. . .Focus. . . Execution. . . Performance

5

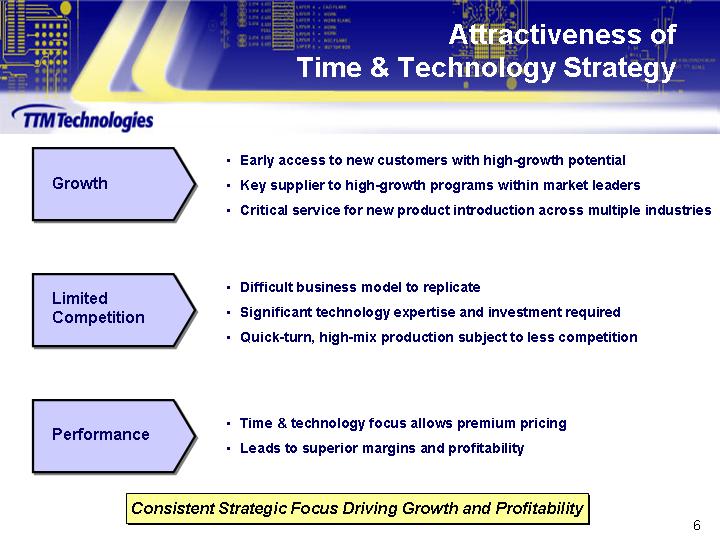

Attractiveness of

Time & Technology Strategy

Growth

Early access to new customers with high-growth potential

Key supplier to high-growth programs within market leaders

Critical service for new product introduction across multiple industries

Limited Competition

Difficult business model to replicate

Significant technology expertise and investment required

Quick-turn, high-mix production subject to less competition

Performance

Time & technology focus allows premium pricing

Leads to superior margins and profitability

Consistent Strategic Focus Driving Growth and Profitability

6

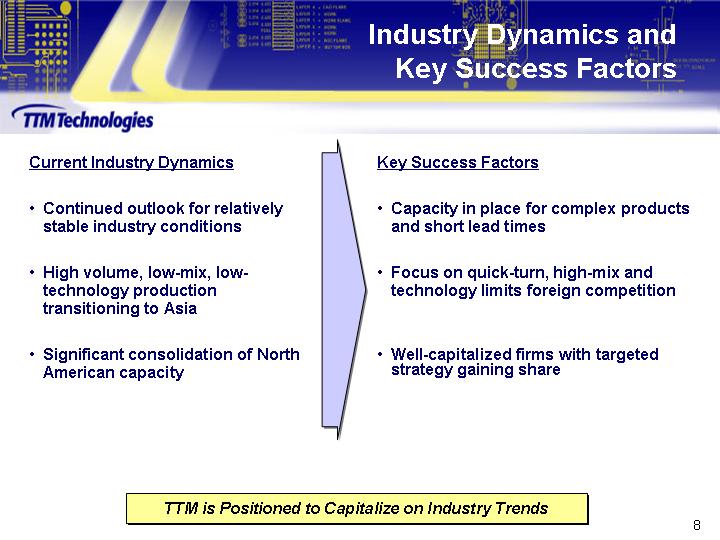

Industry Dynamics and

Key Success Factors

|

Current Industry Dynamics |

|

Key Success Factors |

|

|

|

|

|

Continued outlook for relatively stable industry conditions |

|

Capacity in place for complex products and short lead times |

|

|

|

|

|

High volume, low-mix, low-technology production transitioning to Asia |

|

Focus on quick-turn, high-mix and technology limits foreign competition |

|

|

|

|

|

Significant consolidation of North American capacity |

|

Well-capitalized firms with targeted strategy gaining share |

TTM is Positioned to Capitalize on Industry Trends

8

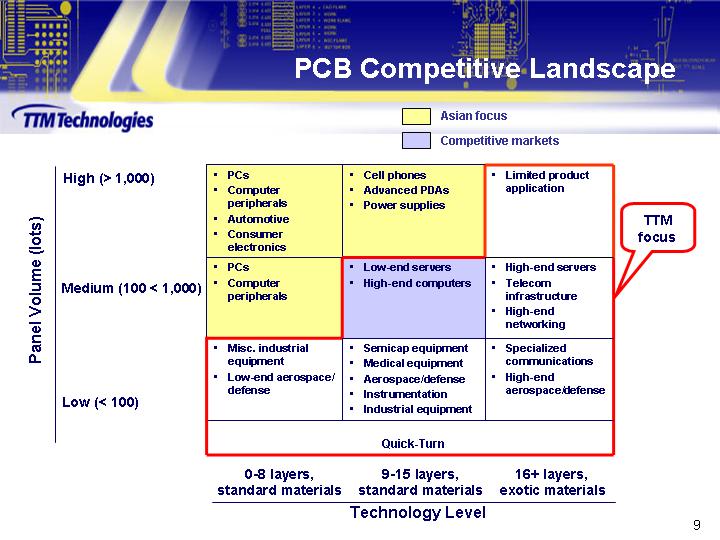

PCB Competitive Landscape

|

|

|

|

Asian focus |

|

|

|

|

|

|

|

|

|

Competitive markets |

|

Panel Volume (lots) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High (> 1,000) |

|

PCs Computer peripherals Automotive Consumer electronics |

|

Cell phones Advanced PDAs Power supplies |

|

Limited product application |

|

|

|

|

|

|

|

|

|

|

|

Medium (100 < 1,000) |

|

PCs Computer peripherals |

|

Low-end servers High-end computers |

|

High-end servers Telecom infrastructure High-end networking |

TTM |

|

|

|

|

|

|

|

|

|

|

Low (< 100) |

|

Misc. industrial equipment Low-end aerospace/defense |

|

Semicap equipment Medical equipment Aerospace/defense Instrumentation Industrial equipment |

|

Specialized communications High-end aerospace/defense |

|

|

|

|

|

|

||||

|

|

|

Quick-Turn |

|

||||

|

|

|

|

|

||||

|

|

|

0-8 layers, |

|

9-15 layers, |

|

16+ layers, |

|

|

|

|

standard materials |

|

standard materials |

|

exotic materials |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Technology Level |

|

|

|

9

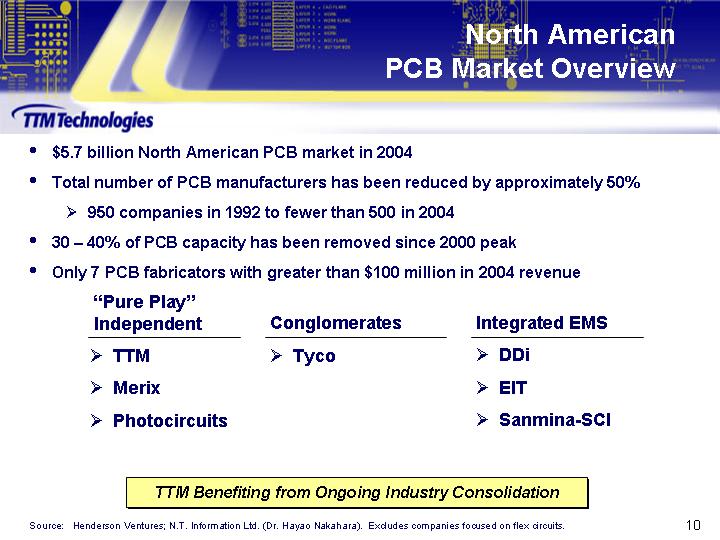

North American

PCB Market Overview

$5.7 billion North American PCB market in 2004

Total number of PCB manufacturers has been reduced by approximately 50%

950 companies in 1992 to fewer than 500 in 2004

30 40% of PCB capacity has been removed since 2000 peak

Only 7 PCB fabricators with greater than $100 million in 2004 revenue

|

Pure

Play |

|

Conglomerates |

|

Integrated EMS |

|

|

TTM |

|

Tyco |

|

DDi |

|

|

Merix |

|

|

|

EIT |

|

|

Photocircuits |

|

|

|

Sanmina-SCI |

|

TTM Benefiting from Ongoing Industry Consolidation

Source: Henderson Ventures; N.T. Information Ltd. (Dr. Hayao Nakahara). Excludes companies focused on flex circuits.

10

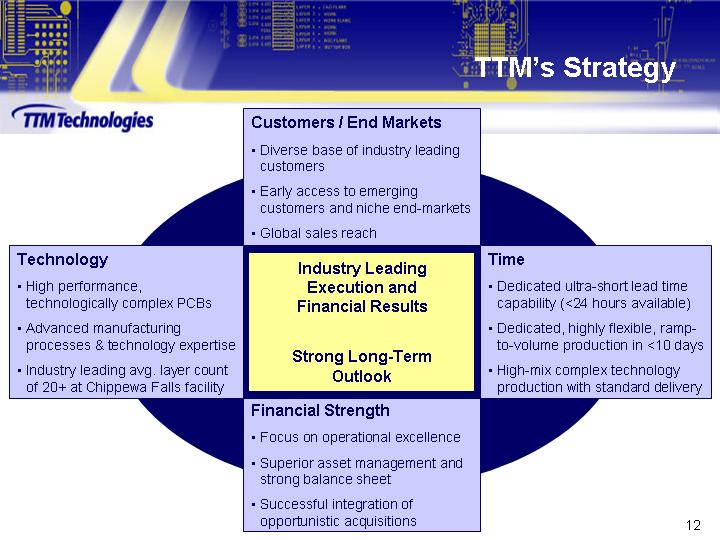

TTMs Strategy

|

|

Customers / End Markets

Diverse base of industry leading customers

Early access to emerging customers and niche end-markets

Global sales reach |

|

|

|

|

|

|

Technology

High performance, technologically complex PCBs

Advanced manufacturing processes & technology expertise

|

Industry

Leading |

Time

Dedicated ultra-short lead time capability (<24 hours available)

Dedicated, highly flexible, ramp-to-volume production in <10 days

|

|

Industry leading avg. layer count of 20+ at Chippewa Falls facility |

Strong

Long-Term |

High-mix complex technology production with standard delivery |

|

|

|

|

|

|

Financial Strength

Focus on operational excellence

Superior asset management and strong balance sheet

Successful integration of opportunistic acquisitions |

|

12

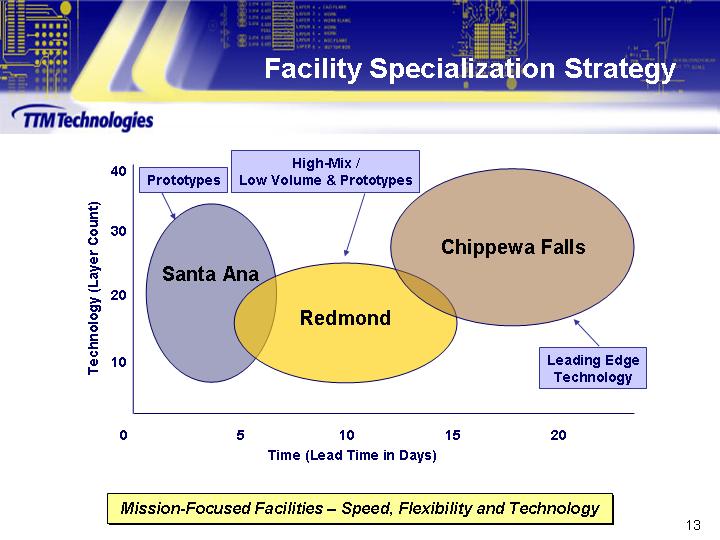

Facility Specialization Strategy

[CHART]

Mission-Focused Facilities Speed, Flexibility and Technology

13

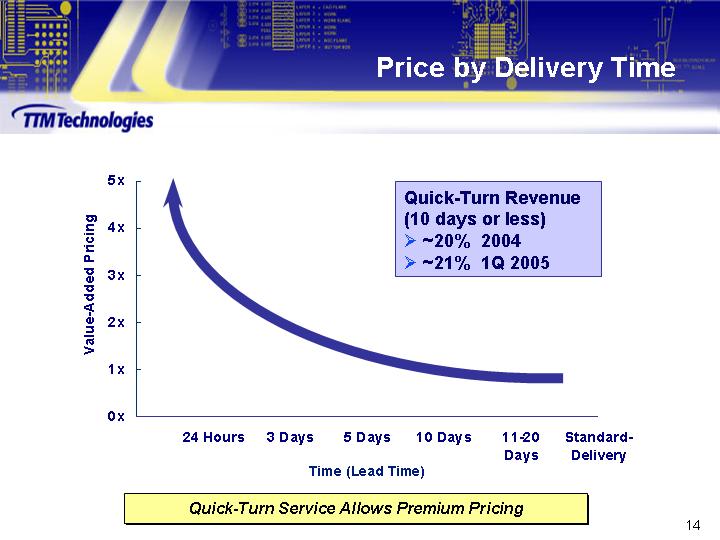

Price by Delivery Time

[CHART]

Quick-Turn Revenue (10 days or less)

~20% 2004

~21% 1Q 2005

Quick-Turn Service Allows Premium Pricing

14

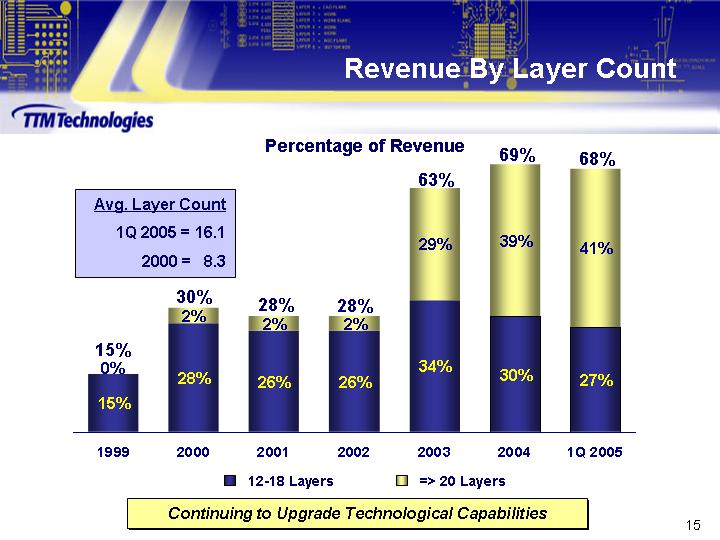

Revenue By Layer Count

Percentage of Revenue

[CHART]

Avg. Layer Count

1Q 2005 = 16.1

2000 = 8.3

Continuing to Upgrade Technological Capabilities

15

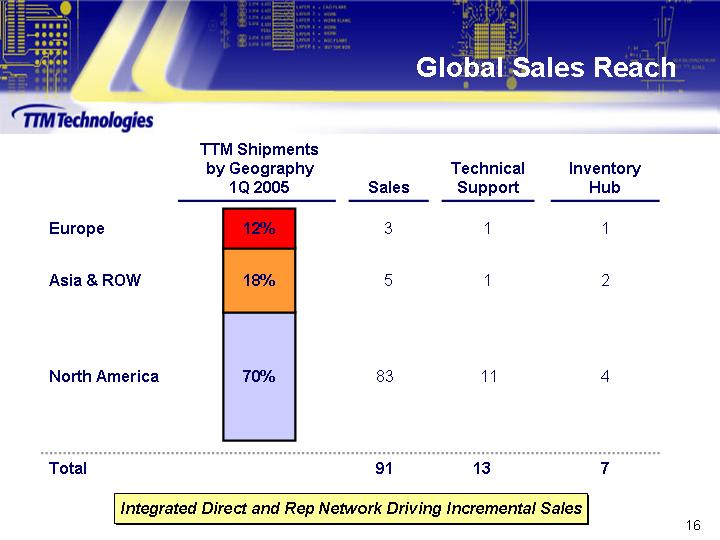

Global Sales Reach

|

|

|

TTM Shipments |

|

|

|

|

|

|

|

|

|

|

by Geography |

|

|

|

Technical |

|

Inventory |

|

|

|

|

1Q 2005 |

|

Sales |

|

Support |

|

Hub |

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe |

|

12 |

% |

3 |

|

1 |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Asia & ROW |

|

18 |

% |

5 |

|

1 |

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

North America |

|

70 |

% |

83 |

|

11 |

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

91 |

|

13 |

|

7 |

|

Integrated Direct and Rep Network Driving Incremental Sales

16

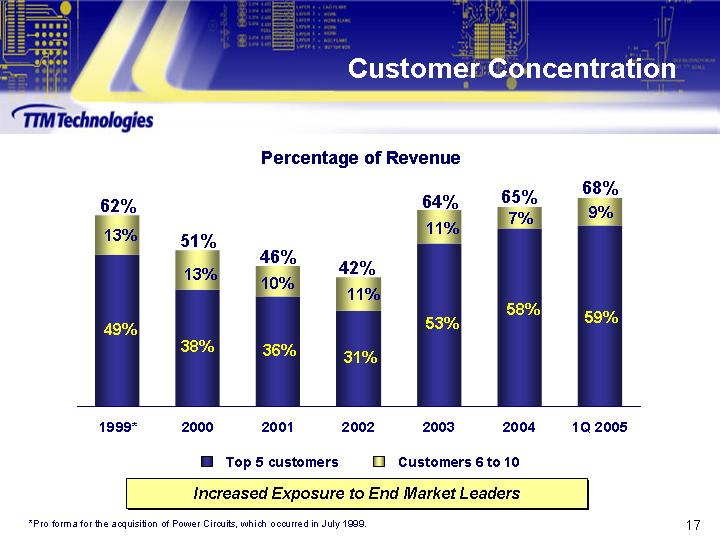

Customer Concentration

Percentage of Revenue

[CHART]

Increased Exposure to End Market Leaders

*Pro forma for the acquisition of Power Circuits, which occurred in July 1999.

17

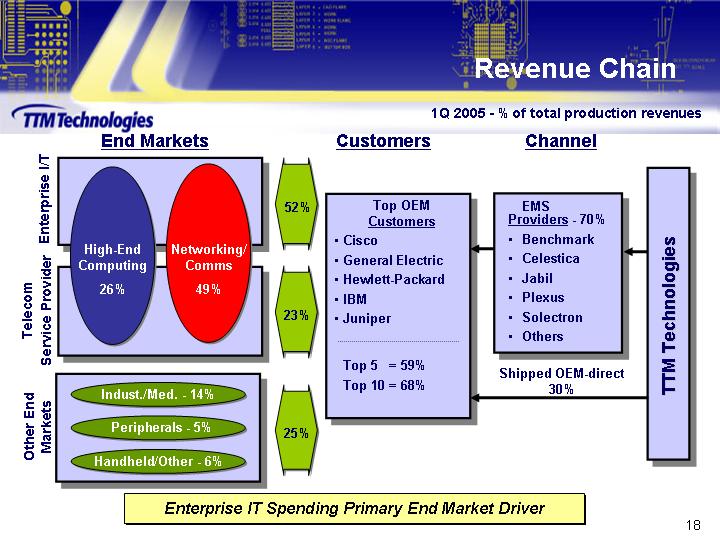

Revenue Chain

1Q 2005 - % of total production revenues

End Markets

|

Enterprise I/T |

|

High-End |

|

Networking / |

|

52% |

|

|

|

|

|

|

|

|

||

|

Telecom Service Provider |

|

|

|

23% |

|

||

|

|

|

|

|

|

|

|

|

|

Other End Markets |

|

Indust./Med. - 14% |

|

25% |

|

||

Customers

Top OEM

Customers

Cisco

General Electric

Hewlett-Packard

IBM

Juniper

|

Top 5 |

= |

59% |

|

Top 10 |

= |

68% |

EMS

Providers - 70%

Benchmark

Celestica

Jabil

Plexus

Solectron

Others

Shipped OEM-direct

30%

TTM Technologies

Enterprise IT Spending Primary End Market Driver

18

Key Customers by

End Market

Percentage of Revenue by End Market 1Q 2005

|

Networking & Communications |

|

49 |

% |

[LOGO] |

|

|

|

|

|

|

|

|

|

High-End Computing |

|

26 |

% |

[LOGO] |

|

|

|

|

|

|

|

|

|

Industrial & Medical |

|

14 |

% |

[LOGO] |

|

|

|

|

|

|

|

|

|

Computer Peripherals |

|

5 |

% |

[LOGO] |

|

|

|

|

|

|

|

|

|

Handheld & Other |

|

6 |

% |

[LOGO] |

|

Leading Positions with Industry

Leaders. . .

Approximately 550 Active Customers

19

Compelling

Growth Opportunities

One-stop manufacturing solution with numerous cross-selling opportunities

Quick-turn capabilities for attracting emerging high-growth customers

Leadership in technology and advanced manufacturing processes

Capacity available through low risk, low cost expansion plan

Successful track record of completing and integrating acquisitions

20

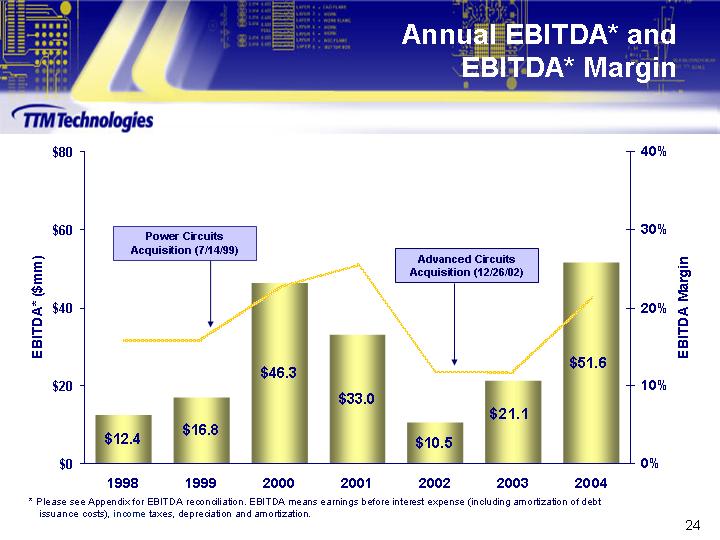

Annual EBITDA* and

EBITDA* Margin

[CHART]

* Please see Appendix for EBITDA reconciliation. EBITDA means earnings before interest expense (including amortization of debt issuance costs), income taxes, depreciation and amortization.

24

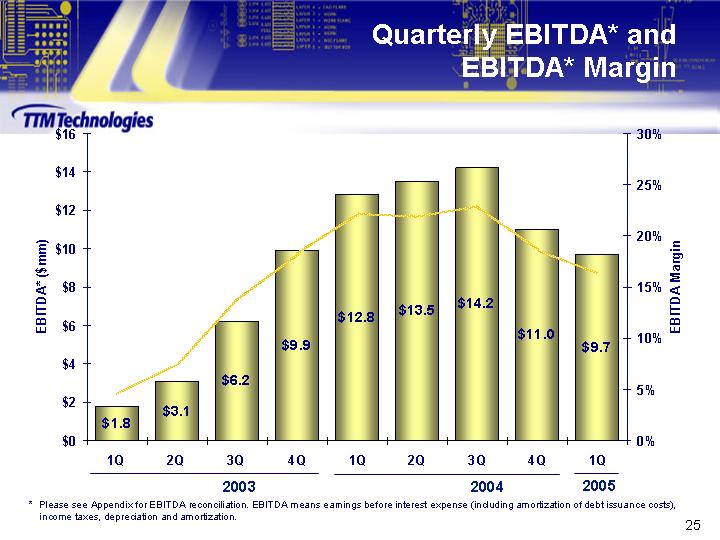

Quarterly EBITDA* and

EBITDA* Margin

[CHART]

* Please see Appendix for EBITDA reconciliation. EBITDA means earnings before interest expense (including amortization of debt issuance costs), income taxes, depreciation and amortization.

25

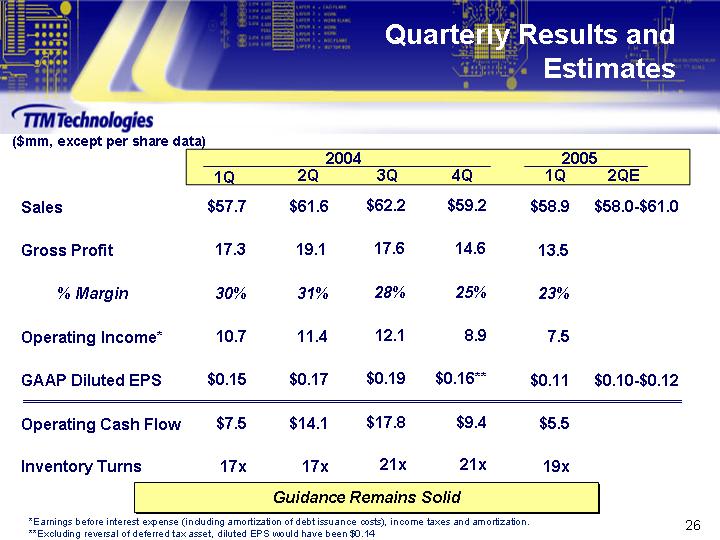

Quarterly Results and

Estimates

($mm, except per share data)

|

|

|

2004 |

|

2005 |

|

||||||||||||||

|

|

|

1Q |

|

2Q |

|

3Q |

|

4Q |

|

1Q |

|

2QE |

|

||||||

|

Sales |

|

$ |

57.7 |

|

$ |

61.6 |

|

$ |

62.2 |

|

$ |

59.2 |

|

$ |

58.9 |

|

$ |

58.0-$61.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Gross Profit |

|

17.3 |

|

19.1 |

|

17.6 |

|

14.6 |

|

13.5 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

% Margin |

|

30 |

% |

31 |

% |

28 |

% |

25 |

% |

23 |

% |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Operating Income* |

|

10.7 |

|

11.4 |

|

12.1 |

|

8.9 |

|

7.5 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

GAAP Diluted EPS |

|

$ |

0.15 |

|

$ |

0.17 |

|

$ |

0.19 |

|

$ |

0.16 |

** |

$ |

0.11 |

|

$ |

0.10-$0.12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Operating Cash Flow |

|

$ |

7.5 |

|

$ |

14.1 |

|

$ |

17.8 |

|

$ |

9.4 |

|

$ |

5.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Inventory Turns |

|

17 |

x |

17 |

x |

21 |

x |

21 |

x |

19 |

x |

|

|

||||||

Guidance Remains Solid

*Earnings before interest expense (including amortization of debt issuance costs), income taxes and amortization.

**Excluding reversal of deferred tax asset, diluted EPS would have been $0.14

26

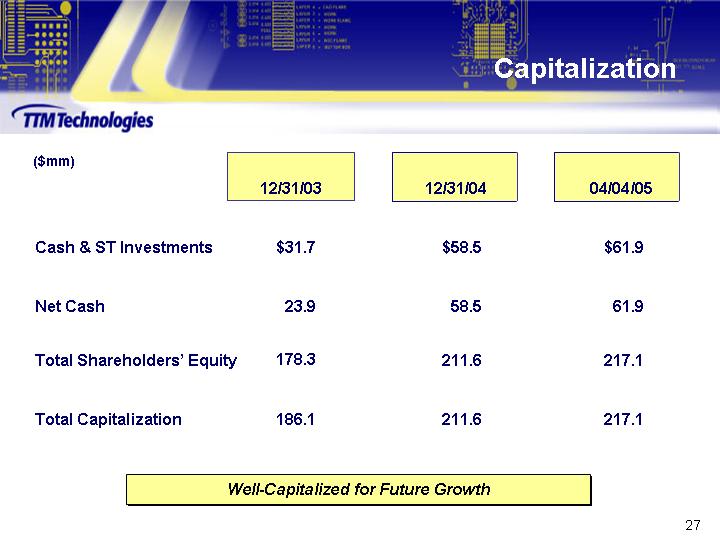

Capitalization

($mm)

|

|

|

12/31/03 |

|

12/31/04 |

|

04/04/05 |

|

|||

|

|

|

|

|

|

|

|

|

|||

|

Cash & ST Investments |

|

$ |

31.7 |

|

$ |

58.5 |

|

$ |

61.9 |

|

|

|

|

|

|

|

|

|

|

|||

|

Net Cash |

|

23.9 |

|

58.5 |

|

61.9 |

|

|||

|

|

|

|

|

|

|

|

|

|||

|

Total Shareholders Equity |

|

178.3 |

|

211.6 |

|

217.1 |

|

|||

|

|

|

|

|

|

|

|

|

|||

|

Total Capitalization |

|

186.1 |

|

211.6 |

|

217.1 |

|

|||

Well-Capitalized for Future Growth

27

Conclusion

Solid industry fundamentals

Focused strategy and strong market position

Demonstrated execution excellence

Industry leading financial performance

28

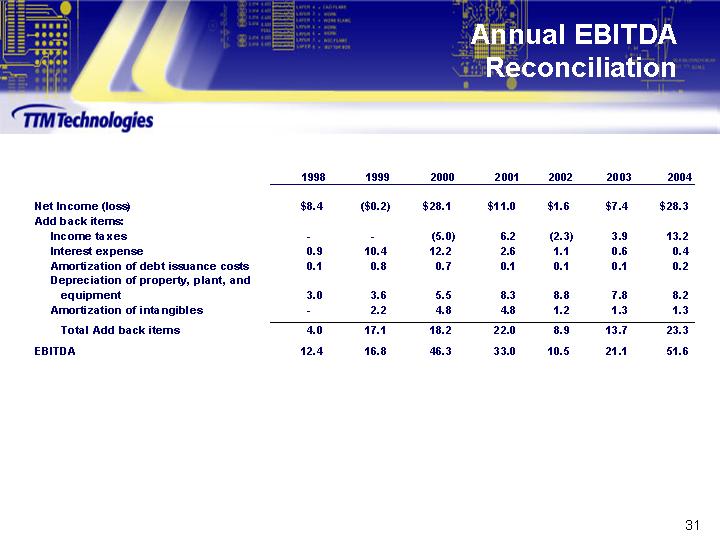

Annual EBITDA

Reconciliation

|

|

|

1998 |

|

1999 |

|

2000 |

|

2001 |

|

2002 |

|

2003 |

|

2004 |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Net Income (loss) |

|

$ |

8.4 |

|

$ |

(0.2 |

) |

$ |

28.1 |

|

$ |

11.0 |

|

$ |

1.6 |

|

$ |

7.4 |

|

$ |

28.3 |

|

|

Add back items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Income taxes |

|

|

|

|

|

(5.0 |

) |

6.2 |

|

(2.3 |

) |

3.9 |

|

13.2 |

|

|||||||

|

Interest expense |

|

0.9 |

|

10.4 |

|

12.2 |

|

2.6 |

|

1.1 |

|

0.6 |

|

0.4 |

|

|||||||

|

Amortization of debt issuance costs |

|

0.1 |

|

0.8 |

|

0.7 |

|

0.1 |

|

0.1 |

|

0.1 |

|

0.2 |

|

|||||||

|

Depreciation of property, plant, and equipment |

|

3.0 |

|

3.6 |

|

5.5 |

|

8.3 |

|

8.8 |

|

7.8 |

|

8.2 |

|

|||||||

|

Amortization of intangibles |

|

|

|

2.2 |

|

4.8 |

|

4.8 |

|

1.2 |

|

1.3 |

|

1.3 |

|

|||||||

|

Total Add back items |

|

4.0 |

|

17.1 |

|

18.2 |

|

22.0 |

|

8.9 |

|

13.7 |

|

23.3 |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

EBITDA |

|

12.4 |

|

16.8 |

|

46.3 |

|

33.0 |

|

10.5 |

|

21.1 |

|

51.6 |

|

|||||||

31

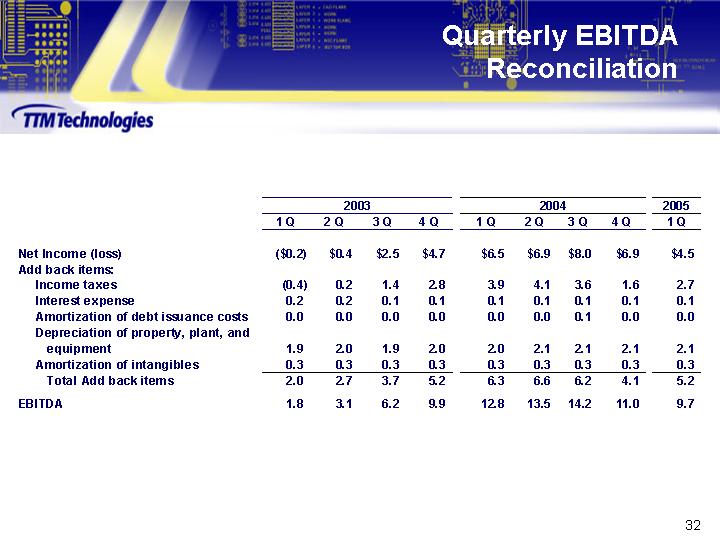

Quarterly EBITDA

Reconciliation

|

|

|

2003 |

|

2004 |

|

2005 |

|

|||||||||||||||||||||

|

|

|

1 Q |

|

2 Q |

|

3 Q |

|

4 Q |

|

1 Q |

|

2 Q |

|

3 Q |

|

4 Q |

|

1 Q |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Net Income (loss) |

|

$ |

(0.2 |

) |

$ |

0.4 |

|

$ |

2.5 |

|

$ |

4.7 |

|

$ |

6.5 |

|

$ |

6.9 |

|

$ |

8.0 |

|

$ |

6.9 |

|

$ |

4.5 |

|

|

Add back items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Income taxes |

|

(0.4 |

) |

0.2 |

|

1.4 |

|

2.8 |

|

3.9 |

|

4.1 |

|

3.6 |

|

1.6 |

|

2.7 |

|

|||||||||

|

Interest expense |

|

0.2 |

|

0.2 |

|

0.1 |

|

0.1 |

|

0.1 |

|

0.1 |

|

0.1 |

|

0.1 |

|

0.1 |

|

|||||||||

|

Amortization of debt issuance costs |

|

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

|

0.1 |

|

0.0 |

|

0.0 |

|

|||||||||

|

Depreciation of property, plant, and equipment |

|

1.9 |

|

2.0 |

|

1.9 |

|

2.0 |

|

2.0 |

|

2.1 |

|

2.1 |

|

2.1 |

|

2.1 |

|

|||||||||

|

Amortization of intangibles |

|

0.3 |

|

0.3 |

|

0.3 |

|

0.3 |

|

0.3 |

|

0.3 |

|

0.3 |

|

0.3 |

|

0.3 |

|

|||||||||

|

Total Add back items |

|

2.0 |

|

2.7 |

|

3.7 |

|

5.2 |

|

6.3 |

|

6.6 |

|

6.2 |

|

4.1 |

|

5.2 |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

EBITDA |

|

1.8 |

|

3.1 |

|

6.2 |

|

9.9 |

|

12.8 |

|

13.5 |

|

14.2 |

|

11.0 |

|

9.7 |

|

|||||||||

32