DEF 14A: Definitive proxy statements

Published on March 27, 2020

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material pursuant to § 240.14a-12 | |||

| TTM TECHNOLOGIES, INC. | ||||

| (Name of Registrant as Specified in its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

|

|||

|

|

||||

| (2) | Aggregate number of securities to which transaction applies:

|

|||

|

|

||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

|

|

||||

| (4) | Proposed maximum aggregate value of transaction:

|

|||

|

|

||||

| (5) | Total fee paid: | |||

|

|

||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

|

|||

|

|

||||

| (2) | Form, Schedule or Registration Statement No.:

|

|||

|

|

||||

| (3) | Filing Party:

|

|||

|

|

||||

| (4) | Date Filed:

|

|||

|

|

||||

Table of Contents

Table of Contents

Proxy Statement Summary

This summary highlights information generally contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting your shares. For more complete information regarding the Companys 2019 performance, please review the Companys Annual Report on Form 10-K for the year ended December 30, 2019, which we refer to in this proxy statement as the 2019 Form 10-K.

Annual Meeting Information

| Date & Time | Location | Record Date | ||

| Thursday, May 7, 2020 | TTM Company Headquarters | Record holders as of | ||

|

8:30 a.m. Pacific Time

(The doors will open at 8:00 a.m. Pacific Time)

|

200 East Sandpointe, Suite 400

Santa Ana, California 92707

|

March 9, 2020 are entitled to Notice of, and to vote at, the Annual Meeting

|

||

The Company is monitoring the situation with COVID-19 (Coronavirus), and in the interest of health and safety, we may hold our meeting solely by means of remote communication. We will announce any such updates as promptly as practicable, and details on how to participate will be issued by press release, posted on our website, and filed with the SEC as additional proxy materials.

Summary of Matters to be Voted Upon at the Annual Meeting

|

Proposal No. |

Description of Proposals |

Required Vote for Approval |

TTM Boards Recommendation |

|||||

| 1 | To elect Kenton K. Alder, Julie S. England and Philip G. Franklin to serve as class II directors

For more information, see page 5 |

For each director, a majority of the votes cast | FOR Each Nominee |

✓ | ||||

| 2 | To approve a proposed amendment to the TTM Technologies, Inc. 2014 Incentive Compensation Plan (the Plan)

For more information, see page 50 |

Majority of shares present and entitled to vote | FOR | ✓ | ||||

| 3 | To approve, on an advisory basis, the compensation of our named executive officers

For more information, see page 56 |

Majority of shares present and entitled to vote | FOR | ✓ | ||||

| 4 | To approve, on an advisory basis, the frequency of future advisory votes on the compensation

of our

For more information, see page 57 |

The frequency of future advisory votes on compensation of our named executive officers will be determined by the highest number of votes cast for option of one year, two years or three years. |

ONE YEAR |

✓ | ||||

| 5 | To ratify the appointment of KPMG LLP as the independent registered public accounting firm

For more information, see page 57. |

Majority of shares present and entitled to vote | FOR | ✓ | ||||

| TTM TECHNOLOGIES, INC. |

|

i |

Table of Contents

A Letter from our Chairman of the Board and our CEO

|

|

|

| Robert E. Klatell, Chairman of the Board | Thomas T. Edman, President and Chief Executive Officer |

Dear Fellow Stockholders,

It is a pleasure to invite all TTM Technologies, Inc. stockholders to our 2020 Annual Meeting of Stockholders. We hope you can join us on May 7, 2020, at 8:30 a.m. at our Company Headquarters at 200 East Sandpointe, Suite 400, Santa Ana, California 92707.

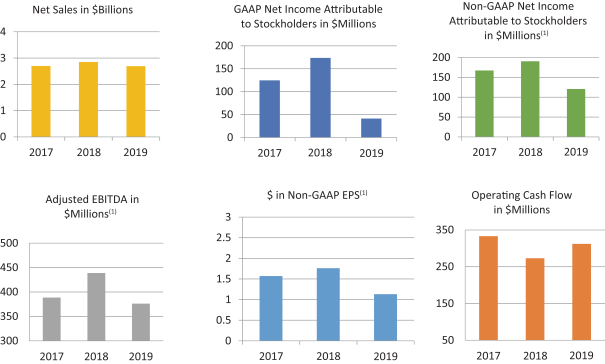

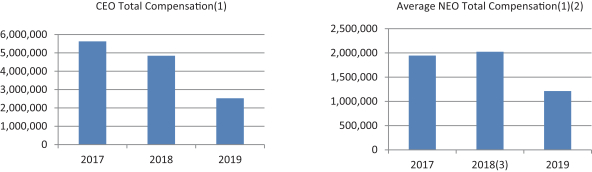

2019 was a challenging and transitional year for TTM. While our aerospace and defense business was strong, our commercial end markets were weak which put pressure on revenues and profits. Despite these dynamics, we were able to grow cash flow year on year and took strategic actions that we expect will strengthen our company in the longer term. We completed the acquisition of the assets and technology of i3 Electronics, Inc. (i3) in November 2019. The i3 assets and technology provide us with key future growth opportunities for advanced applications in the defense and commercial markets, with the ultimate goal of providing differentiated technical support and value for our customers. To capitalize on the i3 acquisition, we opened an engineering center in Binghamton, New York and established a high tech manufacturing facility in Chippewa Falls, Wisconsin to integrate the acquired technology. We believe these new facilities, as well as the the new i3 engineering talent and assets in these facilities, will strengthen our advanced PCB technology capabilities and extend our patent portfolio for emerging applications for the aerospace and defense and high end commercial markets. In addition, we recently announced that we entered into an agreement for the sale of our Mobility Business Unit comprised of four manufacturing facilities in China. The sale of the seasonal and volatile Mobility Business Unit is in line with our strategy to focus on longer cycle and more stable product offerings while providing us with better balance sheet flexibility to strategically grow our business and build on our existing technology portfolio and offerings to our customers.

The three core pillars of TTMs strategic vision are diversification, differentiation and discipline. We believe we have effectively diversified our business by currently focusing our strengths in six end markets. To align with our vision, we have simplified the TTM Mission Statement by concentrating on differentiation to make it clear to our employees and customers that we are taking concrete actions to better realize the potential of our business portfolio. We plan to continue to pursue a disciplined focus on those businesses which tap into the two key aspects of our differentiation: (i) our global footprint capabilities and (ii) the breadth and depth of our technical capabilities.

In addition, our Board believes that TTMs focus on corporate responsibility creates value for the company, the stockholders and other stakeholders by identifying ways for technology to benefit the environment and society while helping us mitigate risks and reduce costs. To emphasize this focus, we have included a disclosure for the first time in this years proxy statement on our environmental, social and governance (ESG) initiatives and policies.

We encourage you to carefully review this years notice and proxy statement, which contain important information about proxy voting and the business to be conducted at the meeting, in addition to highlighting TTMs 2019 financial performance.

| TTM TECHNOLOGIES, INC. |

|

ii |

Table of Contents

Thank you for your continued support of TTM Technologies. We look forward to seeing you at the meeting.

Sincerely,

|

|

|

|

|

Robert E. Klatell |

Thomas T. Edman |

|

| Chairman of the Board |

President and Chief Executive Officer |

| TTM TECHNOLOGIES, INC. |

|

iii |

Table of Contents

About TTM

TTM Technologies, Inc. is a leading technology solutions provider and a preeminent technology solutions company. We strive to generate industry leading growth and profitability, driven by empowered employees, with an unwavering value system. We are a leading competitor in the printed circuit board industry, with significant market presence in each of our end market segments. TTM also designs and develops radio frequency components and sub-assemblies using our own engineering talent and intellectual property.

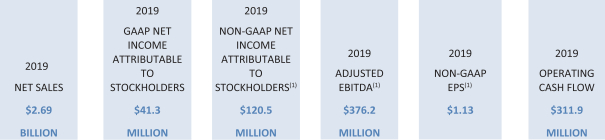

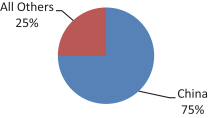

TTM generated $2.69B in revenue in 2019, with 29 manufacturing facilities, located in North America and China. TTM continues to focus on growing faster than the industry in those submarkets that are strategic to TTMs business model. TTM has established a global, customer-focused organization within each business unit chartered to become experts in their markets, strengthen existing customer relationships and develop new customers in growing areas of each market.

TTM has an operational team that has delivered solid financial results and has established a focus on developing leading edge technology positions, integrated supply chain management and burgeoning best practice sharing which form the foundation for future margin improvement. In addition, TTM currently serves six end markets which are: 1) Aerospace and Defense; 2) Automotive, Medical, Industrial and Instrumentation; 3) Communication and Computing; 4) Mobility; 5) Wireless and 6) Electro-Mechanical Solutions. Recently, TTM announced it has entered into an agreement to divest its mobility business unit comprised of four manufacturing facilities in China.

TTM has a global IT infrastructure, data warehouse and enterprise resource planning strategy in place to effectively connect otherwise disparate legacy processes and systems. TTM is aggressively striving to prevent successful cybersecurity attacks and to ingrain security into the DNA of the company. TTM is also actively implementing National Institute of Standards and Technology protocols and diligently protecting the security requirements of our Aerospace and Defense customers.

Our Vision

Inspiring innovation as the preeminent technology solutions company, aspiring to industry leading growth and profitability, driven by empowered employees, with an unwavering value system.

Our Mission

Deliver superior value, growth and profit by providing customers with market leading, differentiated solutions and an extraordinary customer experience.

Our Strategy

| | TTMs intention is to be opportunistic and to partner with the right customers in an industry projecting moderate growth and increasing competition. Our strategy is to provide value through intense focus in three areas: |

| | Investment: Enhancing TTMs overall value proposition to inspire innovation for our customers with disciplined investment in differentiated capabilities and business processes; |

| | Performance: Leading our industry in customer experience, operational and engineering excellence and financial performance; and |

| | Appeal: Improving and communicating the elements that make TTM a desirable employer and attracting, retaining and developing outstanding talent. |

| | The foundation of TTMs strategic vision is its corporate culture and its way of doing business with integrity, teamwork, clear communication, and performance excellence. We encourage our employees to always do the right thing and demonstrate the importance we place on these values by providing ethics training to employees every year. |

| TTM TECHNOLOGIES, INC. |

|

iv |

Table of Contents

TTM TECHNOLOGIES, INC.

200 East Sandpointe, Suite 400

Santa Ana, CA 92707

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 7, 2020

The 2020 annual meeting of stockholders of TTM Technologies, Inc. will be held at 8:30 a.m., local time, on Thursday, May 7, 2020, at our corporate offices located at 200 East Sandpointe, Suite 400, Santa Ana, CA 92707, for the following purposes:

| 1. | to elect three class II directors, consisting of Kenton K. Alder, Julie S. England and Philip G. Franklin, to serve for a term expiring in 2023; |

| 2. | to approve a proposed amendment to the TTM Technologies, Inc. 2014 Incentive Compensation Plan; |

| 3. | to hold an advisory, non-binding vote on the compensation of our named executive officers; |

| 4. | to hold an advisory, non-binding vote on the frequency of future advisory votes on the compensation of our named executive officers; |

| 5. | to ratify the appointment of KPMG LLP as the independent registered public accounting firm for TTM Technologies, Inc. for the fiscal year ending December 28, 2020; and |

| 6. | to consider any other matters that properly come before the meeting and any postponement or adjournment thereof. |

The Company is monitoring the situation with COVID-19 (Coronavirus), and in the interest of health and safety, we may hold our meeting solely by means of remote communication. We will announce any such updates as promptly as practicable, and details on how to participate will be issued by press release, posted on our website, and filed with the SEC as additional proxy materials.

We are pleased to this year again take advantage of the Securities and Exchange Commission (the SEC) rule allowing companies to furnish proxy materials to their stockholders over the Internet. We believe that this e-proxy process expedites stockholders receipt of proxy materials, saves us the cost of printing and mailing these materials, and reduces the environmental impact of our annual meeting by conserving natural resources.

Stockholders of record as of the close of business on March 9, 2020 are entitled to notice of, and to vote at, the annual meeting and any postponement or adjournment thereof. Whether or not you expect to be present, please vote your shares via the Internet by following the instructions in this proxy statement. Of course, if you received a paper copy of this proxy statement you may also vote by signing, dating, and returning the enclosed proxy card in the enclosed pre-addressed envelope. No postage is required if mailed in the United States.

| By Order of the Board of Directors |

||

| Santa Ana, California |

|

|

| March 27, 2020 |

Daniel J. Weber, Secretary |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE STOCKHOLDER MEETING TO BE HELD ON MAY 7, 2020

The proxy statement and annual report to stockholders and the means to vote via the Internet are available at www.ttm.com/stockholdersmeeting. Your Vote is Important Please vote as promptly as possible by using the Internet or by signing, dating, and returning the proxy card if you received a paper copy of this proxy statement.

All stockholders are invited to attend the annual meeting in person. Stockholders who vote their proxy online or by executing a proxy card may nevertheless attend the meeting, revoke their proxy, and vote their shares in person.

Table of Contents

Table of Contents

TTM TECHNOLOGIES, INC.

2020 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

This proxy statement contains information related to our annual meeting of stockholders to be held on Thursday, May 7, 2020, beginning at 8:30 a.m., local time, at our corporate offices located at 200 East Sandpointe, Suite 400, Santa Ana, CA 92707, and at any adjournments or postponements of the meeting. The purpose of this proxy statement is to solicit proxies from the holders of our common stock for use at the meeting. On or about March 27, 2020, we began mailing a notice containing instructions on how to access this proxy statement and our annual report via the Internet, and we began mailing a full set of the proxy materials to stockholders who had previously requested delivery of the materials in paper form. For information on how to vote your shares, see the instructions included on the proxy card and under How to Vote below.

General Information

Matters To Be Considered At The Meeting

The matters to be considered and voted upon at the Meeting will be:

| 1. | Election of Directors. To elect three class II directors, consisting of Kenton K. Alder, Julie S. England and Philip G. Franklin, to serve for a term expiring in 2023. |

| 2. | Approval of a Proposed Amendment to the TTM Technologies, Inc. 2014 Incentive Compensation Plan. To approve a proposed amendment to the TTM Technologies, Inc. 2014 Incentive Compensation Plan (the 2014 Plan) to increase the number of authorized shares that can be awarded under the 2014 Plan by 5,500,000 shares. |

| 3. | Approval of Named Executive Officer Compensation. To approve, on an advisory, non-binding basis, the Companys executive compensation. |

| 4. | Approval of Frequency of Future Advisory Votes on Named Executive Officer Compensation. To approve, on an advisory, non-binding basis, the frequency of future advisory votes on the compensation of our named executive officers. |

| 5. | Ratification of Appointment of Independent Registered Public Accounting Firm. To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 28, 2020. |

| 6. | Other Business. To transact such other business as properly may come before the Meeting or any adjournment or postponement thereof. |

Voting Recommendations Of The Board

Each of the recommendations of our board of directors is set forth together with the description of each item in this proxy statement. In summary, our board of directors recommends a vote (1) FOR the election of each of its three nominees for class II directors; (2) FOR approval of the amendment to the TTM Technologies, Inc. 2014 Incentive Compensation Plan; (3) FOR approval of the compensation of our named executive officers; (4) in favor of an advisory vote on the compensation of our named executive officers every year; and (5) FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 28, 2020. If you sign and return your proxy card but do not specify how you want your shares voted, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of our board of directors.

Our board of directors does not know of any other matters that may be brought before the meeting nor does it foresee or have reason to believe that the proxy holders will have to vote for a substitute or alternate board nominee for director. In the event that any other matter should properly come before the meeting or any nominee for director is not available for election, the proxy holders will vote as recommended by the board of directors or, if no recommendation is given, in accordance with their best judgment.

| TTM TECHNOLOGIES, INC. |

|

1 |

Table of Contents

Who May Vote

Only stockholders of record at the close of business on March 9, 2020, the record date for the annual meeting, are entitled to receive notice of the meeting and to vote the shares of our common stock that they held on that date at the meeting, and any postponements or adjournments of the meeting. Each outstanding share of common stock entitles its holder to cast one vote on each matter to be voted upon at the meeting.

How To Vote

Stockholder of Record. If you are the stockholder of record (that is, the shares are held in your name), you may vote your proxy in one of three convenient ways:

Via the Internet: Go to www.ttm.com/stockholdersmeeting and follow the instructions. You will need the 11-digit control number that appears on your proxy card included with this proxy statement. This method of voting will be available starting March 27, 2020 and through 11:59 p.m., Eastern Time, on May 6, 2020.

By mail: If you wish to vote by traditional proxy card and did not receive one along with this proxy statement, you can receive a full set of materials at no charge through the Internet at www.ttm.com/stockholdersmeeting, by telephone at (888) 776-9962, or by sending an e-mail to info@amstock.com (the subject line of your e-mail should contain the 11-digit control number that appears in the Notice Regarding the Availability of Proxy Materials you received). If you vote by traditional proxy card, mark your selections on the proxy card, date the card, and sign your name exactly as it appears on the card, then mail it in the postage-paid envelope enclosed with the materials. You should mail the proxy card in plenty of time to allow delivery to our transfer agent prior to the meeting.

In Person: If you are attending the meeting, you may deliver your completed proxy card in person.

Street Name Shares. If you hold shares through a bank, broker or other institution, you will receive material from that firm explaining how to vote.

How To Change Or Revoke Your Vote

You may change your vote at any time before the vote at the Meeting. If you are a stockholder of record, you may revoke your proxy and change your vote at any time before the annual meeting by submitting to our corporate secretary at our corporate offices a notice of revocation or a duly executed proxy bearing a later date (or voting via the Internet).

If you hold your shares in street name, you may change your vote any time before the annual meeting by submitting new voting instructions to your bank, broker or other holder of record by following the instructions they provided. The powers of the proxy holders will be suspended if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

What To Do If You Received More Than One Notice

This means that your shares are registered differently and are held in more than one account. To ensure that all shares are voted, please either vote each account over the internet, or sign and return by mail all proxy cards. We encourage you to register all of your shares in the same name and address by contacting the Shareholder Services Department at our transfer agent, American Stock Transfer & Trust Company, at (800) 937-5449. If you hold your shares through an account with a bank or broker, you should contact your bank or broker and request consolidation of your accounts.

Meeting Admission

All stockholders as of the record date, or their duly appointed proxies, may attend the meeting. Please note that if you hold shares in street name (that is, through a bank, broker or other holder of record), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date.

Meeting Quorum

The presence at the meeting, in person or by proxy, of the holders of a majority of all of the shares of common stock outstanding on the record date will constitute a quorum, permitting the conduct of business at the meeting. As of the

| TTM TECHNOLOGIES, INC. |

|

2 |

Table of Contents

record date, 105,957,257 shares of our common stock were outstanding. Abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting.

If less than a majority of the outstanding shares of common stock entitled to vote are represented at the meeting, a majority of the shares present at the meeting may adjourn the meeting to another date, time, or place, and notice need not be given of the new date, time, or place if the new date, time, or place is announced at the meeting before an adjournment is taken.

Required Vote

Proposal One Election of Directors. Assuming that a quorum is present, the three persons receiving the largest number of for votes of our common stock present in person or by proxy at the meeting and entitled to vote (a plurality) will be elected as directors. Stockholders do not have the right to cumulate their votes for directors.

Proposal Two Approval of Amendment to the 2014 Incentive Compensation Plan. The affirmative vote of a majority of the shares of our common stock present in person or represented by proxy at the meeting and entitled to vote will be required to approve a proposed amendment to the TTM Technologies, Inc. 2014 Incentive Compensation Plan (the 2014 Plan) to increase the number of authorized shares that can be awarded under the 2014 Plan by 5,500,000 shares.

Proposal Three Advisory Vote on Named Executive Officer Compensation. The affirmative vote of a majority of the shares of our common stock present in person or represented by proxy at the meeting and entitled to vote will be required for approval of the advisory vote of the compensation of our named executive officers. Because this vote is advisory, it will not be binding upon our board of directors. However, the compensation committee and our board of directors will take into account the outcome of the vote when considering future executive compensation arrangements.

Proposal Four Advisory Vote on Frequency of Future Advisory Votes on Named Executive Officer Compensation. The option of one year, two years or three years that receives the highest number of votes cast will be the frequency of future advisory votes on the compensation of our named executive officers. Because this vote is advisory, it will not be binding upon our board of directors. However, the compensation committee of the board of directors will take into account the outcome of the vote when considering the frequency of future advisory votes on named executive officer compensation.

Proposal Five Ratification of the Appointment of Independent Registered Public Accounting Firm. The affirmative vote of a majority of the shares of our common stock present in person or represented by proxy at the meeting and entitled to vote will be required to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 28, 2020.

Other Matters. For each other matter, the affirmative vote of a majority of the shares of our common stock present in person or represented by proxy at the meeting and entitled to vote will be required for approval.

Broker Non-Votes And Abstentions

If you do not provide your broker or other nominee with instructions on how to vote your street name shares, your broker or nominee will not be permitted to vote them on non-routine matters (a broker non-vote).

Proposals One, Two, Three and Four are considered non-routine matters under applicable rules. Please note that brokers may not vote your shares on these proposals in the absence of your specific instructions as to how to vote. We encourage you to provide instructions to your broker regarding the voting of your shares.

Shares subject to a broker non-vote will not be considered entitled to vote with respect to Proposals One, Two, Three and Four, and will not affect their outcome.

The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 28, 2020 (Proposal Five) is considered a routine matter under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal Five. If a broker non-vote did exist with respect to Proposal Five, it would have the effect of a vote against such proposal.

| TTM TECHNOLOGIES, INC. |

|

3 |

Table of Contents

Abstentions will have no effect on Proposals One and Four. Abstentions will be treated as being present and entitled to vote on Proposals Two, Three and Five and therefore will have the effect of votes against such Proposals.

Cost Of Proxy Solicitation

We will pay the cost of soliciting proxies. In addition to the use of mail, our employees may solicit proxies personally, by e-mail, facsimile, and by telephone. Our employees will receive no compensation for soliciting proxies other than their regular salaries. We may request banks, brokers, and other custodians, nominees, and fiduciaries to forward copies of the proxy materials to the beneficial owners of our common stock and to request authority for the execution of proxies, and we may reimburse such persons for their expenses incurred in connection with these activities.

Our principal executive offices are located at 200 East Sandpointe, Suite 400, Santa Ana, California 92707, and our telephone number is (714) 327-3000. A list of stockholders entitled to vote at the annual meeting will be available at our offices for a period of 10 days prior to the meeting and at the meeting itself for examination by any stockholder.

| TTM TECHNOLOGIES, INC. |

|

4 |

Table of Contents

PROPOSAL ONE ELECTION OF DIRECTORS

Directors and Nominees

Our board of directors is currently comprised of ten directors. Our board of directors is divided into three classes with each class of directors serving for a three-year term or until successors of that class have been elected and qualified. Each director elected at the 2020 annual meeting will serve for a term expiring at the 2023 annual meeting or until his or her successor has been duly elected and qualified. At this annual meeting, our stockholders will be asked to elect three class II directors.

Our board of directors has nominated Kenton K. Alder, Julie S. England and Philip G. Franklin as class II directors. Messrs. Alder and Franklin and Ms. England currently serve as class II directors, and will stand for re-election at the annual meeting.

Rex D. Geveden, Robert E. Klatell and John G. Mayer serve as class III directors and their terms will expire at the annual meeting of stockholders in 2021, and Thomas T. Edman, Chantel E. Lenard, Tang Chung Yen (Tom Tang) and Dov S. Zakheim as class I directors and their terms will expire in 2022. Tang Chung Yen (Tom Tang) has submitted his resignation from the Board effective May 9, 2020.

Pursuant to the terms of the Special Security Agreement that the Company has entered into with the United States Defense Security Service, the Companys board of directors must maintain a Government Security Committee which is to be comprised of at least three (3) independent directors that are eligible to access secret, classified information, as designated by the United States Government. As a natural mechanism to ensure continuity of its board of directors and to maintain adherence with the Special Security Agreement, TTM has continued the practice of providing for staggered elections of three classes of board members to serve three year terms, such that the board of directors is assured to maintain at least six sitting members after each annual meeting of stockholders, of which at least three such members are cleared by the United States Government to receive secret, classified information.

Our board of directors has no reason to believe that any of its nominees will refuse or be unable to accept election. However, if any nominee is unable to accept election or if any other unforeseen contingencies should arise, our board of directors may designate a substitute nominee. If our board of directors designates a substitute nominee, the persons named as proxies will vote for the substitute nominee designated by our board of directors.

Our board of directors recommends a vote FOR the nominees for Class II directors.

The following table, together with the accompanying text, sets forth certain information with respect to each of our directors and director nominees:

|

Name |

Age |

Class |

Position(s) Held |

|||

|

Robert E. Klatell |

74 |

III |

Chairman of the Board |

|||

|

Kenton K. Alder |

70 |

II |

Director |

|||

|

Thomas T. Edman |

57 |

I |

Chief Executive Officer, President and Director |

|||

|

Julie S. England |

62 |

II |

Director |

|||

|

Philip G. Franklin |

68 |

II |

Director |

|||

|

Rex D. Geveden |

59 |

III |

Director |

|||

|

Chantel E. Lenard |

50 |

I |

Director |

|||

|

John G. Mayer |

69 |

III |

Director |

|||

|

Tang Chung Yen (Tom Tang)(1) |

58 |

I |

Director |

|||

|

Dov S. Zakheim |

71 |

I |

Director |

|||

| (1) | Mr. Tang has submitted his resignation from the Board effective May 9, 2020. |

Robert E. Klatell has served as a director of our Company since September 2004 and our chairman of the board since May 2005. Mr. Klatell is presently retired. From September 2009 to the sale of The PBSJ Corporation in October 2010,

| TTM TECHNOLOGIES, INC. |

|

5 |

Table of Contents

Mr. Klatell served as a director of The PBSJ Corporation and a member of its compensation committee, its audit committee and its strategic finance committee. From 2003 to 2009, Mr. Klatell served as a director of Datascope Corp., a medical device company that develops, manufactures, and markets proprietary products for clinical health care markets. From December 2005 to December 2007, Mr. Klatell served as Chief Executive Officer and a director of Kofax plc, which provides information capture and communications solutions. From 2003 to 2006, Mr. Klatell served as a director of Mediagrif Interactive Technologies, an operator of e-business networks and provider of e-business solutions. Mr. Klatell served as a consultant to Arrow Electronics, Inc. from January 2004 to December 2004. Mr. Klatell served in various executive capacities and as a member of the board of directors of Arrow Electronics, Inc. from February 1976 to December 2003, most recently as Executive Vice President from July 1995 to December 2003. Mr. Klatell holds a Bachelor of Arts degree in History from Williams College and a Juris Doctor from New York University School of Law.

Our board of directors has determined that Mr. Klatell is an independent director. Mr. Klatell was nominated to the board of directors because of his extensive experience with operations management and his knowledge of corporate governance and global mergers and acquisitions. Mr. Klatells membership with the National Association of Corporate Directors (NACD) provides him with up-to-date information on corporate governance best practices and the tools necessary to bring leadership to our board of directors. As a result of Mr. Klatells significant involvement in director professionalism education, Mr. Klatell has been designated an NACD Governance Fellow by the National Association of Corporate Directors. Further, Mr. Klatells deep knowledge of the electronics industry and direct experience in the communications industry allows him to contribute a broad perspective to discussions about our future activities and our place in the current competitive landscape.

Kenton K. Alder has served as a director since March 1999. Mr. Alder also served as our President from March 1999 to January 2013 and as our Chief Executive Officer from our founding in 1998 through December 2013. Mr. Alder served on a part-time basis as a consultant and advisor to Mr. Edman for one year commencing on January 1, 2014 through December, 2014 and provided counsel on strategy, attended certain meetings, and was involved in special projects. From January 1997 to July 1998, Mr. Alder served as Vice President of Tyco Printed Circuit Group, Inc., a printed circuit board (PCB) manufacturer. Prior to that time, Mr. Alder served as President and Chief Executive Officer of ElectroStar, Inc., previously a publicly held PCB manufacturing company, from December 1994 to December 1996. From January 1987 to November 1994, Mr. Alder served as President of Lundahl Astro Circuits Inc., a predecessor company to ElectroStar, Inc. Mr. Alder also serves as the chairman of the board of directors and as chairman of the compensation committee of Juniper Systems, Inc. and as the Vice Chairman of the board of directors of Inovar, Inc. In addition, Mr. Alder is a member of the board of directors of Campbell Scientific, Inc. and is a member of its audit committee. Mr. Alder serves as the vice chairman, chairman of the audit committee and a member of the executive committee of Utah State University. Mr. Alder serves as a member of the board of directors of Honeyville, Inc., a manufacturer of food ingredients. Mr. Alder holds a Bachelor of Science degree in Finance and a Bachelor of Science degree in Accounting from Utah State University.

Our board of directors has determined that Mr. Alder is an independent director. Mr. Alder was nominated to the board of directors because of his past experience as our chief executive officer, which enables him to provide the board with insight based on his extensive knowledge about the Company and because of his significant operational expertise.

Thomas T. Edman has served as a director of our Company since September 2004, as President of our Company since January 2013, and as our Chief Executive Officer since January 2014. From early 2011 to December 2012, Mr. Edman served as Group Vice President and General Manager of the AKT Display Business Group, which is a division of Applied Materials Inc., a publicly held provider of nanomanufacturing technology solutions. From 2006 to 2011, Mr. Edman served as Corporate Vice President of Corporate Business Development of Applied Materials, Inc. Prior to that, Mr. Edman served as President and Chief Executive Officer of Applied Films Corporation from May 1998 until Applied Materials, Inc. acquired Applied Films Corporation in July 2006. From June 1996 until May 1998, Mr. Edman served as Chief Operating Officer and Executive Vice President of Applied Films Corporation. From 1993 until joining Applied Films, Mr. Edman served as General Manager of the High Performance Materials Division of Marubeni Specialty Chemicals, Inc., a subsidiary of a major Japanese trading corporation. Since June 2015, Mr. Edman has served on the Board of Ultra Clean Holdings, Inc. (NASDAQ: UCTT) and is presently chairman of the compensation committee and a member of the audit committee. Since March 2016, Mr. Edman has served on the Board of the IPC, an electronic industries association and is currently serving on its executive committee as Treasurer. Mr. Edman holds a Bachelor of Arts degree in East Asian studies (Japan) from Yale University and a Masters degree in Business Administration from The Wharton School at the University of Pennsylvania.

| TTM TECHNOLOGIES, INC. |

|

6 |

Table of Contents

Mr. Edman is an employee director. Mr. Edman was nominated to the board of directors because of his proven business acumen and experience in the technology industry, having served in numerous senior executive roles with sizeable technology companies, including as the chief executive officer of a public company. Mr. Edman also has extensive experience in Asia and with compensation-related matters, which have proven valuable to our board of directors.

Julie S. England has served as a director of our Company since October 2016. Ms. England is presently retired. Prior to her retirement in 2009, she served in various capacities with Texas Instruments Inc., most recently as Vice President and General Manager of the Radio Frequency Identification (RFID) division. She also served as Vice President of its microprocessor division from 1998 to 2004 and as Vice President of Quality for the Semiconductor Group from 1994 to 1998. Earlier, she held various engineering, manufacturing, quality and business management positions. Ms. England is an experienced independent corporate director serving on both private and public company boards in the USA and Europe. Ms. England has served as a director of Smartrac Technology Group, N.V. from 2014 until May 2018. From 2010 until its acquisition by CCL Industries in May 2016, she served as a director of Checkpoint Systems, Inc. and chaired its Governance Committee. Ms. England served as a director of the Federal Reserve Bank of Dallas from 1997 to 2003 and as a director of Intelleflex Corporation from 2010 to 2013. Ms. England served on the Board of Trustees of the Georgia OKeeffe Museum until July 2017, and served on the North Texas Chapter of the National Association of Corporate Directors. She has served on trade associations in the electronics industry including the American Electronics Association and AIM Global. Ms. England holds a Bachelor of Science degree in Chemical Engineering and graduate studies in business from Texas Tech University complemented with executive education at Harvard University and Stanford University. She earned a Bachelor of Fine Art degree in studio art in 2018 from Southern Methodist University in Dallas, TX.

Ms. England is an independent director. Ms. England was nominated to the board of directors because of her extensive background in the technology industry and her experience serving on the boards of both private and public companies in the USA and Europe and to provide the Company with insight as she serves on our board. As a result of Ms. Englands significant involvement in director professionalism education, Ms. England has been designated an NACD Governance Fellow by the National Association of Corporate Directors.

Philip G. Franklin has served as a director of our Company since November 2010. Mr. Franklin is presently retired. From 1998-2016, Mr. Franklin served in various capacities with Littelfuse, Inc. (NASDAQ: LFUS), a designer, manufacturer, and seller of circuit protection devices for use in electronics, automotive and electrical markets, most recently as Executive Vice President and Chief Financial Officer. Prior to joining Littelfuse, Inc., Mr. Franklin was Vice President and Chief Financial Officer for OmniQuip International, a construction equipment manufacturer, which he helped take public. Prior to that, Mr. Franklin served as Chief Financial Officer of Monarch Marking Systems and Hill Refrigeration. Mr. Franklin also serves as non-executive chairman of the board of directors of Tribune Publishing Co. (NASDAQ:TPCO). Mr. Franklin holds a Bachelors degree in Economics from Dartmouth College and a Masters degree in Business Administration from the Amos Tuck School at Dartmouth College.

Our board of directors has determined that Mr. Franklin is an independent director and an audit committee financial expert as described in applicable SEC rules. Mr. Franklin was nominated to the board of directors because of his financial and accounting expertise, including a deep understanding of accounting principles, financial reporting rules and regulations, and knowledge of audit procedures.

Rex D. Geveden has served as a director of our Company since May 2018. Mr. Geveden currently serves as president and chief executive officer since January 1, 2017 and served as chief operating officer from October 2016 until December 2016 of BWX Technologies, Inc. (NYSE:BWXT), a nuclear industrial conglomerate headquartered in Lynchburg, VA. Previously, Mr. Geveden was executive vice president at Teledyne Technologies Incorporated, a provider of electronic subsystems and instrumentation for aerospace, defense and other uses. There he led two of Teledynes four operating segments 2013 through 2016, and concurrently served as President of Teledyne DALSA, Inc., a Teledyne subsidiary, since 2014. Mr. Geveden also served as president and chief executive officer of Teledyne Scientific and Imaging, LLC from 2011 to 2013 and President of both Teledyne Brown Engineering, Inc. and Teledynes Engineered Systems Segment from 2007 to 2011. Mr. Geveden is a former Associate Administrator of the National Aeronautics and Space Administration (NASA), where he was responsible for all technical operations within the agencys $16 billion portfolio and served in various other positions with NASA in a career spanning 17 years. Mr. Geveden holds both a bachelors and masters degrees in physics from Murray State University.

| TTM TECHNOLOGIES, INC. |

|

7 |

Table of Contents

Our board of directors has determined that Mr. Geveden is an independent director. Mr. Geveden was nominated to the board of directors because of his extensive experience in the aerospace and defense industry as well as his proven track record as an outstanding leader.

Chantel E. Lenard has served as a director of our Company in November 2018. Ms. Lenard presently serves as a Lecturer of Marketing in the MBA program at the University of Michigan Ross School of Business. Ms. Lenard retired from Ford Motor Company (NYSE:F) in 2017, having served as the top marketing executive for Ford in both the U.S. and Asia. From 2013 to 2017, Ms. Lenard held the position of U.S. Chief Marketing Officer, leading the organizations pricing, promotions, media, digital marketing, product strategy, and consumer experience activities. From 2010 to 2013, Ms. Lenard was based in Shanghai, China, as Vice President of Marketing for Fords Asia Pacific and Africa operations, where she led the marketing activities for 11 countries across the region. In addition to her marketing roles, Ms. Lenard held a number of leadership positions in strategy, sales, finance, and purchasing during her 25 year career with Ford. Ms. Lenard holds a bachelors degree in industrial engineering from Purdue University and a masters degree in business administration from Harvard University.

Our board of directors has determined that Ms. Lenard is an independent director. Ms. Lenard was nominated to the board of directors because of her extensive background in the automobile industry and her lengthy and diverse experience in international marketing.

John G. Mayer has served as a director of our Company since September 2000. Mr. Mayer is presently retired. From January 1997 to November 1999, Mr. Mayer served as Vice President of Tyco Printed Circuit Group, Inc., a PCB manufacturer. Mr. Mayer served as Chief Operating Officer of ElectroStar, Inc., previously a publicly held PCB manufacturing company, from December 1994 to December 1996. From April 1986 to November 1994, Mr. Mayer served as President of Electro-Etch Circuits, Inc., a predecessor company to ElectroStar, Inc. Mr. Mayer served on the board of trustees of the Cottonwood Gulch Foundation from 2008 to 2017. Mr. Mayer holds a Bachelor of Arts degree in History, the Arts and Letters from Yale University and a Juris Doctor from UCLA School of Law.

Our board of directors has determined that Mr. Mayer is an independent director. Mr. Mayer was nominated to the board of directors because of his extensive experience in the PCB business and has demonstrated depth of business experience in our companys industry, particularly in technology and operations.

Tang Chung Yen (Tom Tang) is currently a member of our board, but has submitted his resignation effective May 9, 2020. He has served as a director of our Company since April 2010. In addition, Mr. Tang previously served as a board member of TTM Technologies (Asia Pacific) Limited, one of our subsidiaries in Hong Kong. Prior to that, he was the Executive Chairman and Group Managing Director of Meadville Holdings Limited (Meadville), the business of which he joined in 1991. Mr. Tang has served as the honorary chairman and honorary founding chairman of The Hong Kong Printed Circuit Association Limited since 2005 and 2009, respectively, and is the honorary chairman of The Hong Kong Exporters Association since 2012. Mr. Tang is the chairman of The Hong Kong Standards and Testing Centre Limited and The Hong Kong Safety Institute Limited, a vice chairman of HK Wuxi Trade Association Limited, and an executive vice-chairman of The Federation of HK Jiangsu Community Organisations. Since 2008, Mr. Tang has been a member of both the Shanghai Committee and the Wuxi Committee of The Chinese Peoples Political Consultative Conference. In 2018, he left the Shanghai Committee to become a member of the Jiangsu Committee of The Chinese Peoples Political Consultative Conference. Mr. Tang holds a Master of Business Administration from New York University.

Our board has determined that because of Mr. Tangs extensive experience with PCB operations in Asia and his business acumen, as evidenced by his senior executive role with Meadville, a company acquired by TTM, he continues to provide valuable insight to the Companys board of directors. Mr. Tang is not an independent director based on his recent employment with the Company and his beneficial ownership of approximately 5.8% of the outstanding shares of the Company.

Dov S. Zakheim has served as a director of our Company since July 2010. Dr. Zakheim is currently a Senior Fellow at CNA, a federally funded think tank, and a Senior Advisor at the Center for Strategic and International Studies. From May 2004 to July 2010, Dr. Zakheim served as Vice President and subsequently as Senior Vice President of Booz Allen Hamilton, a global strategy and technology consulting firm, where he was a leader in the firms global defense practice. From May 2001 to April 2004, Dr. Zakheim was Under Secretary of Defense (Comptroller) and Chief Financial Officer for the United States

| TTM TECHNOLOGIES, INC. |

|

8 |

Table of Contents

Department of Defense. From October 2002 to April 2004, Dr. Zakheim served as the United States Department of Defenses coordinator of civilian programs in Afghanistan. Dr. Zakheim serves as the Chairman of the board of directors of Sprint Federal Operations LLC. Dr. Zakheim previously served as a member of the board of directors of Standard Aero Corp. from 2008 until 2015, and was a member of their audit committee from 2012 to 2015. In addition, Dr. Zakheim has served as a member of ISO Group, Inc.s board of directors from 2010 to 2014. Dr. Zakheim also served as a board member of Chemonics International and has been a member of their audit committee from 2013 to 2019. Dr. Zakheim also serves as a board member of the American Jewish Committee, the Foreign Policy Research Institute, and the Center for the National Interest and the U.S. Naval Academy Athletic Association. Dr. Zakheim holds a Bachelor of Arts degree from Columbia College at Columbia University, was a General Course student at the London School of Economics, and holds a Doctor of Philosophy from St. Antonys College at the University of Oxford.

Our board of directors has determined that Dr. Zakheim is an independent director and an audit committee financial expert as described in applicable SEC rules. Dr. Zakheim was nominated to the board of directors because of his substantial financial and accounting experience acquired in the course of acting as Chief Financial Officer for the U.S. Department of Defense, his expertise and leadership skills in global defense, and his national security qualifications.

There are no family relationships among any of our directors, director nominees, or executive officers.

Information Relating to Corporate Governance and the Board of Directors

Our board of directors has determined, after considering all the relevant facts and circumstances, that Messrs. Alder, Franklin, Geveden, Klatell and Mayer, Ms. England, Ms. Lenard and Dr. Zakheim are independent directors, as independence is defined by the listing standards of the NASDAQ Stock Market (referred to as NASDAQ) and by the Securities and Exchange Commission (referred to as the SEC). Accordingly, a majority of the members of our board of directors are independent. In 2017, our board of directors determined, after considering all the relevant facts and circumstances, that sufficient time had passed since Mr. Alders employment with the Company for him to be considered independent under NASDAQ rules. Mr. Edman is not considered to be an independent director as a result of his position as an executive officer of our Company. Mr. Tang is not considered to be an independent director as a result of his former position as an executive with Meadville and certain of its subsidiaries and his indirect holding of approximately 5.8% of our shares.

Our bylaws authorize our board of directors to appoint its members to one or more committees, each consisting of one or more directors. Our board of directors has established four standing committees: an audit committee, a compensation committee, a nominating and corporate governance committee, and a government security committee. Each of our committees, with the exception of the government security committee (of which Mr. Edman is also a member), is comprised entirely of independent directors, as independence is defined by the listing standards of NASDAQ and by the SEC. Our board of directors holds executive sessions following all in-person board meetings at which the independent directors meet without the presence or participation of management.

Our board of directors has adopted charters for the audit, compensation, and nominating and corporate governance committees describing the authority and responsibilities delegated to the committee by the board of directors. Our board of directors has also adopted corporate governance guidelines, a whistle blower policy, a code of business conduct for all employees and a supplemental code of ethics for our chief executive officer and senior financial officers. We post on our website, at https://investors.ttm.com/corporate-governance/highlights, the charters of our audit, compensation, and nominating and corporate governance committees; our corporate governance guidelines; our whistle blower policy; our code of conduct for all employees, our code of ethics for our chief executive officer and senior financial officers, and any amendments or waivers thereto. These documents are also available in print to any stockholder requesting a copy in writing from our corporate secretary at 200 East Sandpointe, Suite 400, Santa Ana, California 92707.

Interested parties may communicate with our board of directors or specific members of our board of directors, including the members of our various board committees, by submitting a letter addressed to the board of directors of TTM Technologies, Inc., c/o any specified individual director or directors, at 200 East Sandpointe, Suite 400, Santa Ana, California 92707. We will forward any such letters to the indicated directors.

| TTM TECHNOLOGIES, INC. |

|

9 |

Table of Contents

Environmental, Social & Governance (ESG) Overview

It is our policy to operate worldwide in a safe, responsible manner that respects the environment and protects the safety and health of our employees, our customers and the communities where we operate. We are committed to conducting our business operations in an ethical manner with honesty and integrity. Our Board of Directors oversees our ESG compliance and initiatives through regular engagement with our management team. Our commitment goes beyond regulatory compliance and is an integral part of our corporate culture and our way of doing business. Below are some of our key ESG initiatives.

| | Environmental TTM practices responsible environmental management to protect its employees, customers, community, stockholders, and the environment. TTM monitors its environmental performance and provides the resources necessary to meet its environmental responsibilities. We report emissions, energy usage and water usage to the regulatory agencies as required. Our practices are aimed at improving the environmental sustainability in the communities where we operate. We have recently been recognized by the United States Environmental Protection Agency (the EPA) for our leadership in the EPAs 2018 Toxics Release Inventory Analysis. In 2019, TTM committed $4.9M in capital and $53.4M in other expenses for environmental safeguarding initiatives at its facilities around the globe. Our environmental policy is available on our website at https://www.ttm.com/support/library.aspx#environment. |

| | Social TTM is committed to ensuring an inclusive work environment where all employees are respected and feel comfortable expressing their authentic selves at work. In addition, TTM is committed to providing a safe and rewarding work place for all its employees with fair compensation and benefits and opportunities for advancement. Compensation decisions are based on individual merit and display of competence and skill, as well as a comparison to the pay of others in similar roles of similar skills. TTM routinely produces reports to verify that it is adhering to its internal employment policies, as well as to all federal, state and local laws. The Company maintains a Code of Business Conduct that is an integral part of our corporate culture and our way of doing business. The Code applies to all employees, officers and directors and sets forth the Companys expectation for ethical conduct and additional guidance for employees. In addition, the Company maintains high standards for all employees worldwide which include reasonable work hours and time off, no child labor, no forced labor, equal opportunity employment, and a professional work environment that does not tolerate any form of harassment or discrimination. The Company and its employees strive to achieve and maintain a positive work environment. In addition, the Company emphasizes health and wellness programs targeted to educate employees on healthy lifestyles and promote fitness plans. |

| | Governance A key component of our success is a strong foundation of Corporate Governance practices and policies that promote transparency, accountability and engagement exemplified by our Board of Directors. We maintain our Corporate Governance Guidelines to provide direction to our Board of Directors and Senior Management on topics such as Board member qualifications, the evaluation process for the CEO and Board members and reporting conflicts of interest. In addition to the Guidelines, TTM also maintains a Code of Ethics for the CEO and Senior Financial Officers. In addition, each committee of the board of directors has a charter. All of these documents are available on TTMs website at https://investors.ttm.com/corporate-governance/highlights. |

Meetings of the Board of Directors

Our board of directors held eight meetings (regular and special) during 2019. All of our directors attended more than 75% of the aggregate of (i) the total number of meetings of the board of directors held during 2019, and (ii) the total number of meetings held by all committees of our board of directors on which such person served during 2019. We have adopted a policy encouraging each of our directors to attend each annual meeting of stockholders and, to the extent reasonably practicable, we regularly schedule a meeting of the board of directors on the same day as the annual meeting of stockholders. All of our directors attended the 2019 annual meeting of stockholders.

| TTM TECHNOLOGIES, INC. |

|

10 |

Table of Contents

Committees of the Board of Directors

The members and nominees of the Board and the committees of the Board on which they serve as of the date of this Proxy Statement are identified below:

| Name | Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee |

Government Security Committee |

||||

|

Robert E. Klatell |

Chairman |

Member |

Member |

|||||

|

Kenton K. Alder |

Member |

|||||||

|

Thomas T. Edman |

Member |

|||||||

|

Julie S. England |

Member |

Member |

Member |

|||||

|

Philip G. Franklin |

Chairman |

Member |

||||||

|

Rex D. Geveden |

Member |

Member |

||||||

|

Chantel E. Lenard |

Member |

|||||||

|

John G. Mayer |

Chairman |

Member |

||||||

|

Tang Chung Yen (Tom Tang) |

||||||||

|

Dov S. Zakheim |

Member |

Chairman |

||||||

Audit Committee. Our audit committee reviews and monitors our corporate financial reporting and our external audit, including, among other things, our internal audit and internal control functions, the results and scope of the annual audit, and other services provided by our independent registered public accounting firm and our compliance with legal requirements that have a significant impact on our financial reports. Our audit committee also consults with our management and our independent registered public accounting firm regarding the preparation of financial statements and, as appropriate, initiates inquiries into aspects of our financial affairs. In addition, our audit committee has the responsibility to consider and recommend the appointment of, and to pre-approve services provided by, and fee arrangements with, our independent registered public accounting firm. The current members of our audit committee are Ms. England, Mr. Franklin (chairman), and Dr. Zakheim, each of whom is an independent director under NASDAQ listing standards as well as under SEC rules. The board of directors has determined that each of Mr. Franklin and Dr. Zakheim is financially sophisticated under NASDAQ rules and qualifies as an audit committee financial expert in accordance with applicable rules and regulations of the SEC. Our audit committee held four meetings during 2019.

Our audit committee has a written charter that delineates its responsibilities, a full copy of which is posted on our website at www.ttm.com.

Compensation Committee. Our compensation committee provides a general review of our employee compensation and benefit plans to ensure that they meet our corporate objectives. The compensation committee reviews and determines, or recommends to our board of directors, the compensation of our chief executive officer and all other individuals designated by our board of directors as executive officers of our Company. In addition, our compensation committee reviews and approves our corporate goals and objectives relevant to the compensation for our chief executive officer and other executive officers, including annual performance objectives, and evaluates the performance of our chief executive officer and other executive officers in light of these goals and objectives. The compensation committee reviews and makes recommendations to our board of directors with respect to, or approves, our incentive compensation plans and equity-based plans, and activities relating to those plans. The compensation committee also establishes and periodically reviews policies in the area of perquisites for executive officers. The compensation committee may, from time to time, delegate any or all of its responsibilities to a subcommittee.

In discharging its responsibilities, our compensation committee is empowered to investigate any matter of concern that it deems appropriate and has the sole authority, without seeking approval from the entire board of directors, to retain outside consultants for this purpose, including the authority to approve any terms of retention. Additional information regarding the role of compensation consultants and executive officers in assisting our compensation committee in

| TTM TECHNOLOGIES, INC. |

|

11 |

Table of Contents

determining the amount or form of executive compensation may be found in Compensation Discussion and Analysis below. The current members of our compensation committee are Messrs. Klatell (chairman) and Geveden and Ms. Lenard, each of whom is an independent director under NASDAQ listing standards as well as under SEC rules. The compensation committee held eight meetings during 2019.

Our compensation committee has a written charter that delineates its responsibilities, a full copy of which is posted on our website at www.ttm.com.

Compensation Consultant and its Affiliates. Mercer, LLC (Mercer) was retained by our compensation committee to provide an independent review of the Companys board and executive compensation programs, including an analysis of the competitive market for 2019. Our compensation committee assessed the independence of Mercer pursuant to SEC and NASDAQ rules and concluded that Mercer is independent and that the work of Mercer has not raised any conflict of interest. For further discussion of the work conducted by Mercer as our compensation consultant, see Compensation Discussion and Analysis Role of the Compensation Committee.

Nominating and Corporate Governance Committee. The nominating and corporate governance committee oversees the selection and composition of our board of directors and oversees the management continuity planning processes. It establishes, monitors, and recommends the purpose, structure, and operations of the various committees of our board of directors, the criteria and qualifications for membership of each board committee, and recommends whether rotations or term limits are appropriate for the chair or committee members of the various committees. In addition, the nominating and corporate governance committee recommends individuals to stand for election as directors and recommends directors to serve on each committee as a member or as chair of the committee. The nominating and corporate governance committee reviews director compensation and recommends changes in director compensation to our board of directors with the support of our compensation consultants, Mercer. The nominating and corporate governance committee reviews and makes recommendations regarding our governing documents (including our certificate of incorporation and bylaws) and our corporate governance principles. The nominating and corporate governance committee is also responsible for considering policies relating to the meetings of our board of directors and considers questions of independence and possible conflicts of interest of members of our board of directors and executive officers. Finally, the nominating and corporate governance committee oversees the evaluation of our board of directors and management.

The nominating and corporate governance committee will consider persons recommended by stockholders for inclusion as nominees for election to our board of directors if the information required by our bylaws is submitted in writing in a timely manner and addressed and delivered to our Companys secretary at 200 East Sandpointe, Suite 400, Santa Ana, California 92707. A stockholder who intends to recommend a nominee to our board of directors must provide (a) all information relating to the individual subject to the nomination that is required to be disclosed in opposition proxy statements for election of directors filed by stockholders, at their own expense, in a contested election, or as otherwise required under Regulation 14A under the Securities Exchange Act of 1934, as amended (referred to as the Exchange Act), and (b) the individuals written consent to being named in a proxy statement as a nominee and to serving as a director if elected. The stockholder making the nomination must also provide the information required by our bylaws relating to such stockholder, including information pertaining to ownership of our capital stock, and must make certain representations relating to voting intent and delivery of proxies. The stockholders nominee must also deliver to our secretary a written questionnaire with respect to the background and qualification of such person and the background of any other person or entity on whose behalf the nomination is being made. The questionnaire is available from our secretary upon written request and upon the requesting persons providing certain written representations required by our bylaws.

The nominating and corporate governance committee identifies and evaluates nominees for our board of directors, including nominees recommended by stockholders, based on numerous factors it considers appropriate, some of which may include strength of character, mature judgment, career specialization, relevant technical skills, diversity, and the extent to which the nominee would fill a present need on our board of directors. The nominating and corporate governance committee evaluates nominees for director in the same manner, regardless of whether the nominee is recommended by a stockholder or other person or entity.

In making its selection of director candidates, our nominating and corporate governance committee bears in mind that the foremost responsibility of a director is to represent the interests of our stockholders as a whole. Directors are

| TTM TECHNOLOGIES, INC. |

|

12 |

Table of Contents

expected to exemplify the highest standards of personal and professional integrity and to constructively challenge management through their active participation and questioning. In consideration of these expectations, the nominating and corporate governance committee seeks directors with established strong professional reputations and expertise in areas relevant to the strategy and operations of our business. The activities and associations of candidates are reviewed for any legal impediment, conflict of interest, or other consideration that might prevent service on our board of directors.

The charter of our nominating and corporate governance committee provides that the value of diversity on our board of directors should be considered, and the nominating and corporate governance committee includes diversity as one of its criteria for board composition. While we do not have a formal policy outlining the diversity standards to be considered when evaluating director candidates, our objective is to foster diversity of thought on our board of directors. To accomplish that objective, the nominating and corporate governance committee considers ethnic and gender diversity, as well as differences in perspective, professional experience, education, national security qualifications, skill and other qualities in the context of the needs of our board of directors. The nominating and corporate governance committee evaluates its effectiveness in achieving diversity on the board of directors through its annual review of board member composition, which includes an assessment of directors ethnicity, gender, and industry experience, prior to recommending nominees for election.

The current members of our nominating and corporate governance committee are Messrs. Mayer (chairman) and Klatell and Ms. England, each of whom is an independent director under NASDAQ listing standards as well as under SEC rules. The nominating and corporate governance committee held five meetings during 2019.

Our nominating and corporate governance committee has a written charter that delineates its responsibilities, a full copy of which is posted on our website at www.ttm.com

Government Security Committee. As previously disclosed in our filings with the SEC, a portion of our business consists of manufacturing defense and defense-related items for various departments and agencies of the U.S. government, including the U.S. Department of Defense, which requires that we maintain facility security clearances under the National Industrial Security Program (referred to as NISP). The NISP requires that a corporation maintaining a facility security clearance take steps to mitigate foreign ownership, control, or influence (referred to as FOCI). As we have also previously reported, we are party to a Special Security Agreement with the United States Defense Security Service. That special security agreement, among other things, requires that our board of directors appoint a government security committee comprised of outside directors and directors who are officers of our Company, each of whom must be a U.S. resident citizen that are eligible to access secret information, as classified by the United States Government. The government security committee is responsible for ensuring that we maintain appropriate policies and procedures to safeguard the classified and export-controlled information in our possession and to ensure that we comply with applicable laws and agreements. The current members of our government security committee are Ms. England, Dr. Zakheim (chairman), and Messrs. Alder, Edman, Franklin, Geveden, Klatell, and Mayer. The government security committee held four meetings during 2019.

Board Leadership Structure

We believe it is our chief executive officers responsibility to manage our Companys operations and the chairmans responsibility to lead our board of directors. Given the significant responsibilities with which our chairman is tasked and his active role in our governance, we believe it is beneficial to have an independent chairman whose sole job is leading the board of directors. To this end, our corporate governance guidelines provide that our chief executive officer may not be our chairman, and that our chairman will be selected from our independent directors. In making its decision to separate the chief executive officer and chairman roles, our board of directors considered the time that Mr. Edman is required to devote to the chief executive officer position in the current economic environment, particularly given the demands imposed on our global Company. By segregating the role of the chairman, we reduce any duplication of effort between the chief executive officer and the chairman. We believe this provides strong leadership for our board of directors, while also positioning our chief executive officer as the leader of the Company in the eyes of our customers, employees, and other stakeholders. Our board of directors believes that Mr. Klatell is the most appropriate individual to serve as chairman because of his deep knowledge of our business and strategy, his experience with corporate governance matters, and his demonstrated skill and commitment to performing effectively as chairman of our board of directors.

Our board of directors currently has eight independent members and two non-independent members, specifically Mr. Edman, our president and chief executive officer, and Mr. Tang. A number of our independent board members are

| TTM TECHNOLOGIES, INC. |

|

13 |

Table of Contents

currently serving or have served as members of senior management of other public companies or governmental agencies and have served as directors of other public companies. We believe that the number of independent, experienced directors that make up our board, along with the independent oversight of the board of directors by a non-executive chairman, benefits our Company and our stockholders.

The special security agreement to which we are a party establishes certain criteria for the qualifications of our directors and the composition of our board of directors, and also requires that a certain number of directors have strong national security qualifications, have no prior relationship with certain affiliates described in the special security agreement, and be U.S. citizens holding or eligible to hold personnel security clearances. Our current board of directors meets the composition criteria.

We believe that we have a strong corporate governance structure that ensures independent discussion among, evaluation of, and communication with and access to, senior management. With the exception of our government security committee of which Mr. Edman is a member, all of our board committees are composed solely of independent directors, which provide independent oversight of management. Also, our corporate governance guidelines provide that our independent directors will meet in executive session not less frequently than quarterly.

Risk Management and Oversight Process

While our management is primarily responsible for managing risk, our board of directors and each of its committees play a role in overseeing our risk management practices. Our full board of directors is ultimately responsible for risk oversight, and it discharges this responsibility by, among other things, receiving regular reports from our management concerning our business and the material risks that our Company faces. Our board of directors annually reviews key enterprise risks identified by management, such as financial, reputational, safety and security, cyber security, social responsibility, environmental and compliance risks, and it monitors key risks through reports and discussions regarding key risk areas at meetings of our board of directors and in committee meetings. Our board of directors also focuses on specific strategic and emerging risks in periodic strategy reviews. Our board of directors annually reviews and approves our corporate strategy and goals and our capital budgets, and in connection with that review, it considers risks associated with our Company.

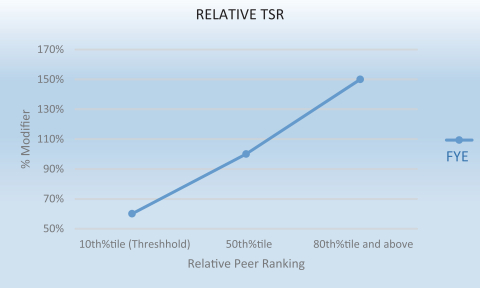

Our board of directors allocates responsibility for overseeing risk management for our Company among the full board and each of its committees. Specifically, the full board oversees significant risks primarily relating to operations, strategy, and finance, environmental, health and cyber security and safety matters, liability insurance programs, and compliance with environmental legal and regulatory and social responsibility requirements. In addition, each of our committees considers risks within its area of responsibilities, as follows: